MUMBAI: Unity Small Finance Bank has taken the lead in the competitive bidding for Aviom India Housing Finance, which is backed by impact investors, tendering an upfront payment of ₹775 crore, according to multiple sources familiar with the situation.

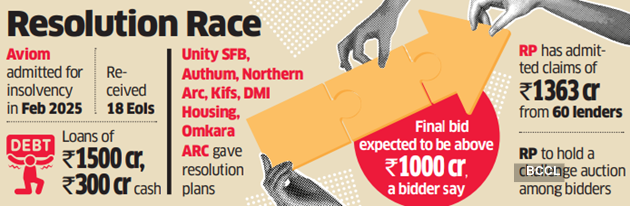

Other competitors include Authum Investment and Infrastructure, Northern Arc, DMI Housing, Kifs Housing Finance, and Omkara Asset Reconstruction Company.

Authum has proposed ₹750 crore, consisting of ₹450 crore upfront with the remainder staggered over two years. Northern Arc submitted an offer of ₹625 crore, including ₹325 crore upfront and the rest payable in two years.

DMI Housing’s offer includes an upfront payment of ₹400 crore, while Omkara and Kifs presented bids of ₹450 crore and ₹325 crore, respectively.

“The interest from bidders is substantial, primarily due to the security of the entire loan portfolio. Aviom has ₹300 crore in cash reserves, and all bad loans have been provided for,” remarked a senior official advising one of the bidders.

Impact investing refers to funding entities to achieve meaningful social outcomes alongside the potential for returns on investment.

Unity SFB, Authum, Northern Arc, DMI Housing, Kifs, Omkara ARC, and the Resolution Professional did not respond to RealtyDailyNews’s inquiries. Recently, private equity investors have shown notable interest in housing finance companies, increasing Aviom’s attractiveness.

For example, Blackstone purchased an 80% stake in Aadhar Housing Finance, Warburg Pincus acquired 84% of Shriram Housing Finance, and a TPG Global affiliate took over Griham Housing Finance (formerly Poonawala Housing Finance).

Given the heightened interest in the sector, it is possible for bids to exceed four-digit figures. Some investors who missed the Expression of Interest (EoI) deadline are eager to participate in the bidding,” the senior official stated. The Resolution Professional has received 18 compliant EoIs, with six presenting resolution plans.

The Reserve Bank of India has appointed Ram Kumar, a former general manager at Punjab National Bank, as the resolution professional, who will soon conduct a challenge auction among the resolution applicants to determine the successful bidders.

Unity SFB is 51% owned by Centrum Financial Services, with BharatPe parent Resilient Innovations holding 49%. Following the collapse of the cooperative PMC Bank, Unity was amalgamated and now boasts a net loan book of ₹10,985 crore.

Aviom India Housing Finance, founded by Kajal Ilmi, faced difficulties after auditors flagged inconsistencies in its financial statements, leading to investigations by the National Housing Bank (NHB). The NHB found that Aviom had inflated its investments in mutual funds to show higher cash balances. RealtyDailyNews first reported on these developments on November 26 and November 28, 2024.

In February, the RBI initiated corporate resolution for the company under the Insolvency and Bankruptcy Code after Aviom started defaulting on loans.

Aviom’s loan book totals ₹1,500 crore with cash balances exceeding ₹300 crore. The Resolution Professional has accepted 60 claims amounting to ₹1,363 crore, with LIC Housing Finance making the largest claim at 7.2%. Other claims, below 3%, include HDFC Bank, Kotak Mahindra Investments, and Tata Capital.