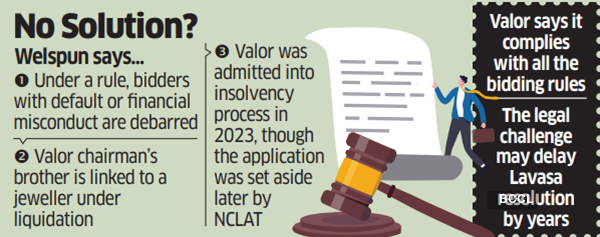

MUMBAI: The Welspun Group has submitted a petition to the Mumbai bench of the National Company Law Tribunal (NCLT), pointing to past defaults in an effort to disqualify top bidder Valor Estates from the debt resolution process for Lavasa Corp, known for its ambition to establish India’s first planned hill city.

This interlocutory application, filed through a Welspun subsidiary, emphasizes connections between Valor’s promoters and another delinquent, debt-ridden jeweler, which could lead to automatic disqualification under the law.

The submitted plea alleges that Valor’s ineligibility stems from Section 29A of the bankruptcy code, which precludes individuals with a record of financial misconduct, willful default, or criminal conviction from participating in a resolution process.

A source familiar with the situation noted, “This plea could significantly delay the resolution—possibly for years. Neither party is likely to concede, indicating a lengthy process ahead.”

According to Welspun’s plea, Pramod Goenka, the brother of Valor chairman Vinod Goenka, qualifies as a connected person under the law and is recognized as a promoter of Yash Jewellery, which has been classified as a non-performing asset since March 30, 2014, and currently remains in default and is under liquidation.

Emails sent to resolution professional Udayraj Patwardhan and a Welspun spokesperson did not receive any replies.

A spokesperson for Valor stated that the company complies with the bankruptcy code and the established resolution process, which includes all necessary regulations regarding bidding eligibility.

“All submissions—including confirmations pertinent to Section 29A—have been made and will continue to be submitted to the resolution professional and the Committee of Creditors as per their guidelines,” the spokesperson added. “We expect all involved parties to respect the confidentiality obligations associated with the bidding documents.”

‘Chequered Past’

The Welspun petition alleges that both Vinod and Pramod Goenka provided personal guarantees to secure loans for Yash Jewellery, thus linking them to the defaulting entity, which disqualifies them from presenting a proposal for Lavasa. It also mentions that another Valor subsidiary, Goan Hotels & Realty, has been classified as a non-performing asset due to loans owed to Yes Bank.