MUMBAI: Unity Small Finance Bank has successfully bid for the bankrupt Aviom India Housing Finance, offering an upfront payment of ₹977.5 crore, according to sources familiar with the matter.

Initially, six companies expressed interest in acquiring Aviom India Housing Finance under the National Company Law Tribunal (NCLT) process, with three ultimately participating in the auction held last week.

Areion, a fund backed by Omkara Asset Reconstruction Company, and Authum Investment and Infrastructure were the other two bidders in the auction conducted by Ram Kumar, the RBI-appointed administrator and former general manager of Punjab National Bank.

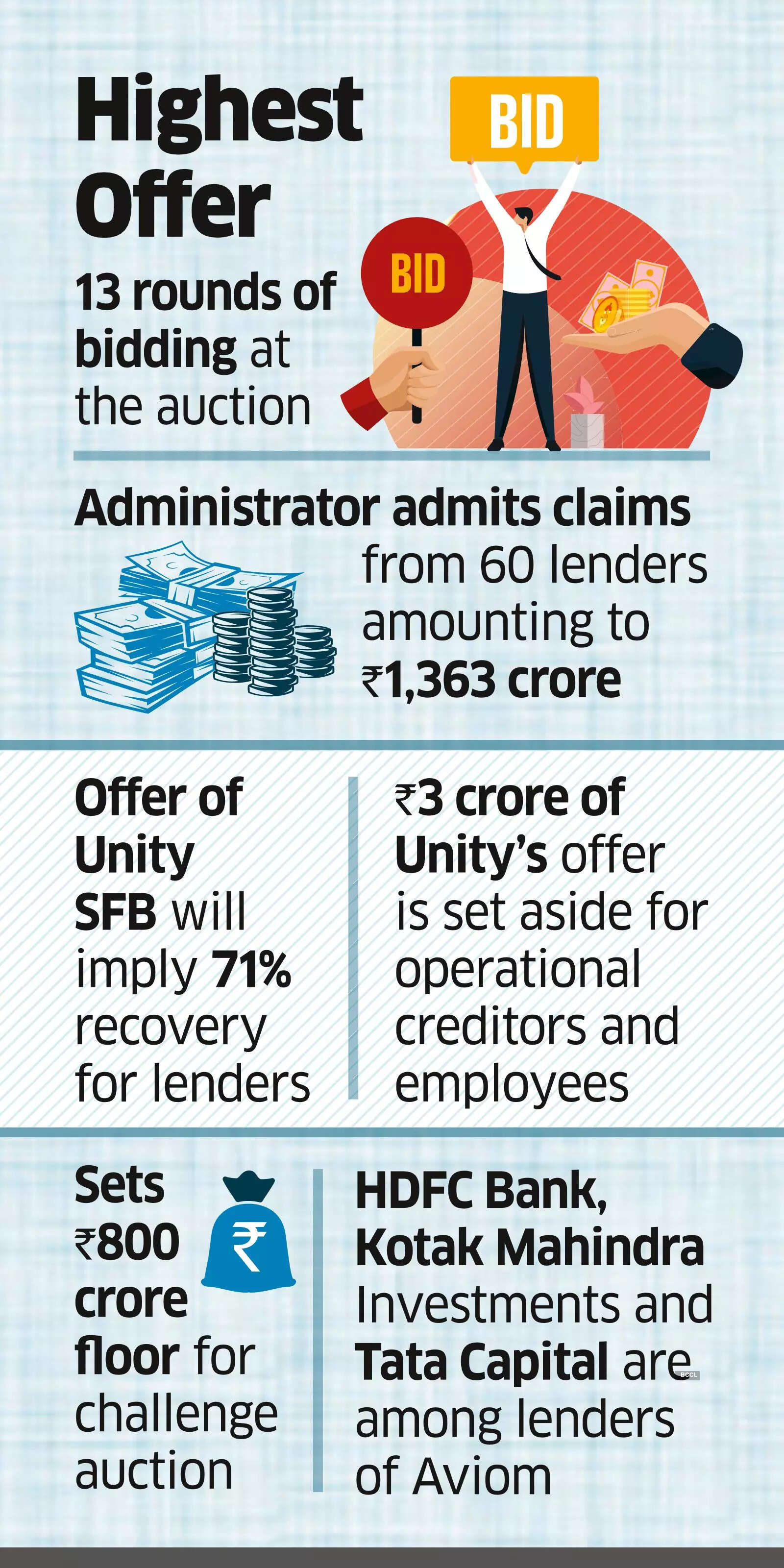

“The bidding involved 13 rounds, with Areion and Authum exiting after making final offers of ₹936 crore and ₹850 crore, respectively,” an advisor to one of the bidders, who requested anonymity, stated.

The entities involved, including the administrator and the bidders, did not respond to queries from RealtyDailyNews.

Aside from the auction participants, Northern Arc, DMI Housing, and Kifs Housing Finance submitted resolution plans to creditors but did not engage in the auction process.

The administrator established a minimum floor price of ₹800 crore and required a minimum increment of ₹25 crore for subsequent bids.

Unity SFB is primarily owned by Centrum Financial Services (51%) with the remaining 49% held by Resilient Innovations, the parent company of BharatPe. It was formed from the amalgamation with PMC bank after its collapse.

Unity SFB’s winning bid of ₹977.5 crore suggests a 71% recovery for lenders, with approximately ₹3 crore earmarked for operational creditors and employees.

The administrator has acknowledged 60 claims totaling ₹1,363 crore, with LIC Housing Finance presenting the largest claim at 7.2%. Other notable claims under 3% come from HDFC Bank, Kotak Mahindra Investments, and Tata Capital.

Prior to the auction, the administrator had reviewed six plans, with Unity SFB’s initial offer being ₹775 crore, as reported on November 10.

Authum proposed ₹750 crore (₹450 crore upfront, with the rest staggered over two years), while Northern Arc put forth a ₹625 crore offer (₹325 crore upfront, with the remaining amount due over two years).

Additionally, Kajal Ilmi, founder of Aviom India Housing Finance, proposed a ₹1,363 crore settlement to be repaid within 26 months, although lenders deemed this offer unfavorable.

The RBI placed Aviom India Housing Finance under corporate resolution per the Insolvency and Bankruptcy Code in February after the company began defaulting on its loans.