RBI Urges NBFCs, HFCs to Uphold Underwriting Standards

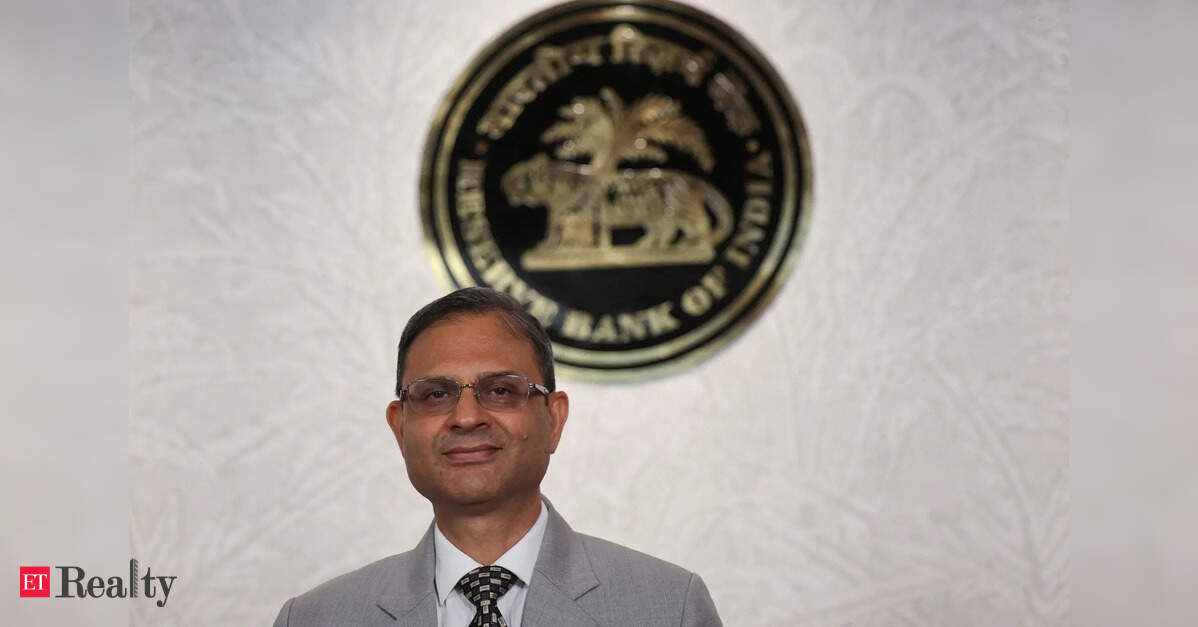

Sure! Here’s a rewritten version of the content you provided: MUMBAI: On Monday, Reserve Bank Governor Sanjay Malhotra emphasized the necessity for robust underwriting standards and meticulous asset quality monitoring during a meeting with senior officials from selected non-banking financial companies (NBFCs). This engagement is part of the Reserve Bank’s ongoing dialogue with regulated entities. The Governor convened with managing directors and chief executive officers (MDs and CEOs) of various NBFCs, including government-backed firms, housing finance companies (HFCs), and microfinance institutions. In his opening remarks, the Governor acknowledged the vital role NBFCs and HFCs play in promoting credit flow. He…