MUMBAI: India’s largest mortgage lender, State Bank of India (SBI), has raised home loan rates by 25 basis points for new borrowers, indicating a potential shift towards higher interest rates in the housing market.

This increase mainly impacts applicants with lower credit scores, as SBI adjusts the upper band of its loan rates. Union Bank of India has also raised its rates, and other public sector lenders may follow.

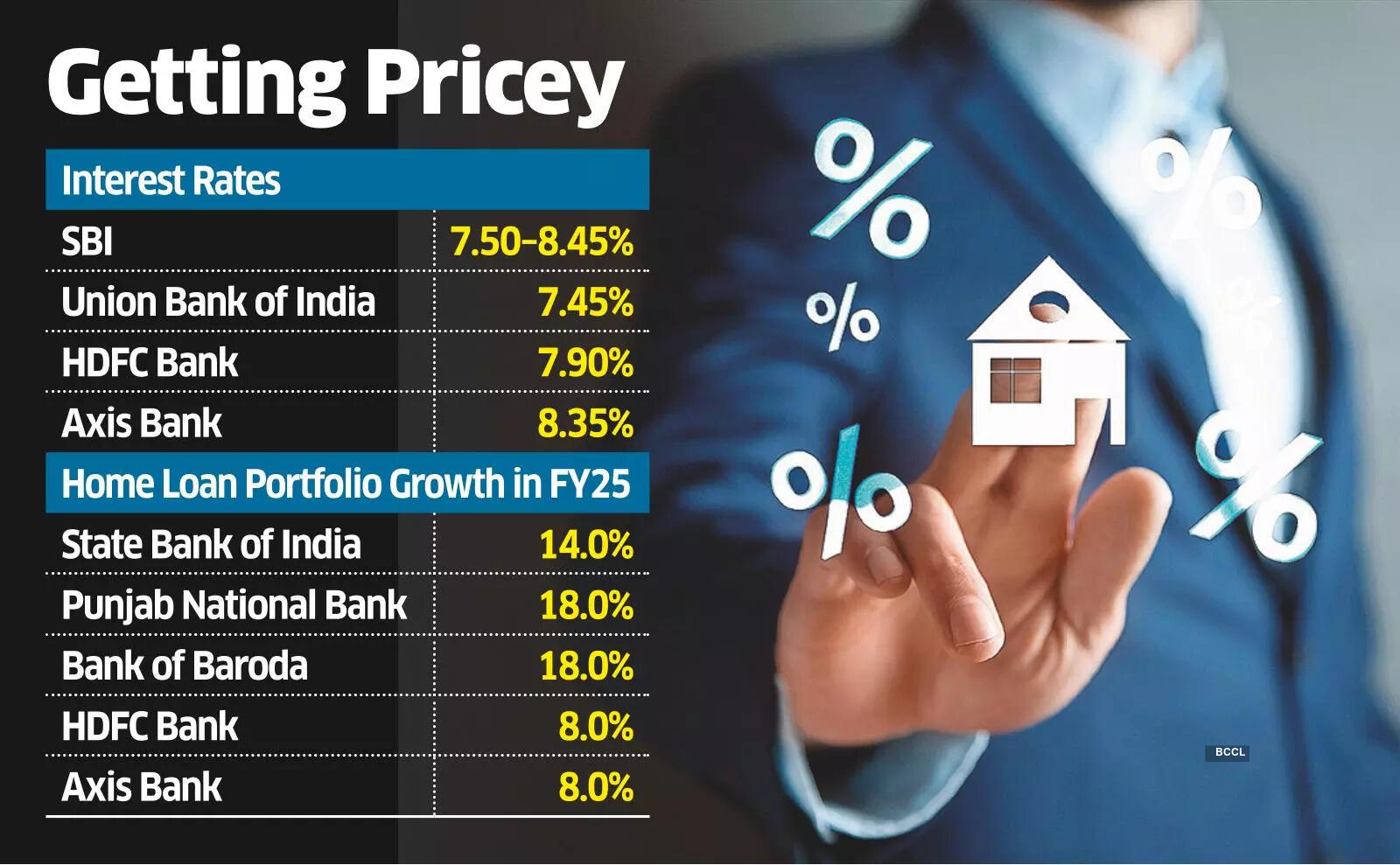

As of late July, SBI’s mortgage rates were between 7.5% and 8.45%. Post-adjustment, new borrowers will face rates between 7.5% and 8.70%. Union Bank of India has upped its rate to 7.45% from 7.35%.

Both banks did not respond to emails seeking clarification on the rate hike.

In contrast, private lenders like HDFC Bank, ICICI Bank, and Axis Bank currently offer home loans starting at 7.90%, 8%, and 8.35%, respectively.

“Yes, SBI has adjusted the rates based on CIBIL scores and the External Benchmark Lending Rate (EBLR). This product yields low returns, so we’ve decided to increase margins for new borrowers with low credit scores. This change impacts only new customers and does not affect the ₹8 lakh crore of existing loans,” remarked a source familiar with the matter.

Home loans represent the largest segment of SBI’s retail lending portfolio. Private banks have criticized public sector banks for their aggressive pricing strategies.

HDFC Bank announced nearly 7% year-on-year growth in its home loan portfolio for the first quarter of this financial year, though it remained flat compared to the previous quarter. Bank officials attributed the slowdown to the “irrational pricing” of competitors, arguing that pursuing growth at the cost of profitability is unsustainable.

“Mortgage rates are still very low. In many cities, they’re advertised at 7.2% to 7.3%, levels unseen in recent years,” stated HDFC Bank’s Chief Financial Officer, Srinivasan Vaidyanathan, during a recent earnings call. “We prioritize the right kind of customer for a comprehensive relationship and have been selective in our approach.”

The pricing pressure has heightened following a 100 basis point cut in the repo rate by the Reserve Bank of India, which now stands at 5.5%.

ICICI Bank recorded a 10.3% increase in its mortgage portfolio for the quarter, with home loans representing two-thirds of the growth. However, this was slower than the 14.2% growth seen a year earlier, indicating weaker demand and increased competition.

Mixed Data

Axis Bank reported a year-on-year decline in home loan volumes, a sector it has faced challenges in expanding for several quarters.

For FY25, ICICI Bank saw an 11% increase in its home loan book, surpassing private sector competitors HDFC Bank (8%) and Axis Bank (6%). Public sector banks outperformed, with SBI growing its home loan portfolio by 14%, while Bank of Baroda and Punjab National Bank each reported an 18% increase.

The rate increases by SBI and Union Bank may indicate a strategic pivot away from low-margin retail loans, with renewed focus on more profitable lending areas.

RBI data shows that home loans grew by 9.6% in the year ending June 2025, a significant drop from the 36.3% growth seen the previous year.

The timing of these increases coincides with a falling repo rate and pressure on net interest margins for banks. Many public sector banks had aggressively priced home loans, leveraging their expansive customer reach. Analysts have warned that such low-yield products, while expanding loan books, are unsustainable due to their lack of profitability.

“The industry is feeling the pressure amid a declining interest rate trend and increasing pressure on net interest margins. Raising interest rates on select products could provide banks with additional income and improve returns,” noted Asutosh Mishra, a lead BFSI analyst at Ashika Stock Broking.

In the past four years, government-owned banks have steadily increased their market share. According to data from credit bureau CRIF Highmark, public sector banks’ share of new home loans by value rose to 43% in FY25 from 34% in FY22, while private banks’ share dwindled from 42.6% to 29.8% during the same period.