MUMBAI: The National Housing Bank (NHB) has implemented new regulations for refinancing home loans on properties that are still under construction. According to an order issued to home financiers, NHB will now offer refinance only for loans where less than half of the construction is completed at the time of the initial disbursement.

This regulation specifically pertains to loans designated for construction on plots or for building homes on self-owned land.

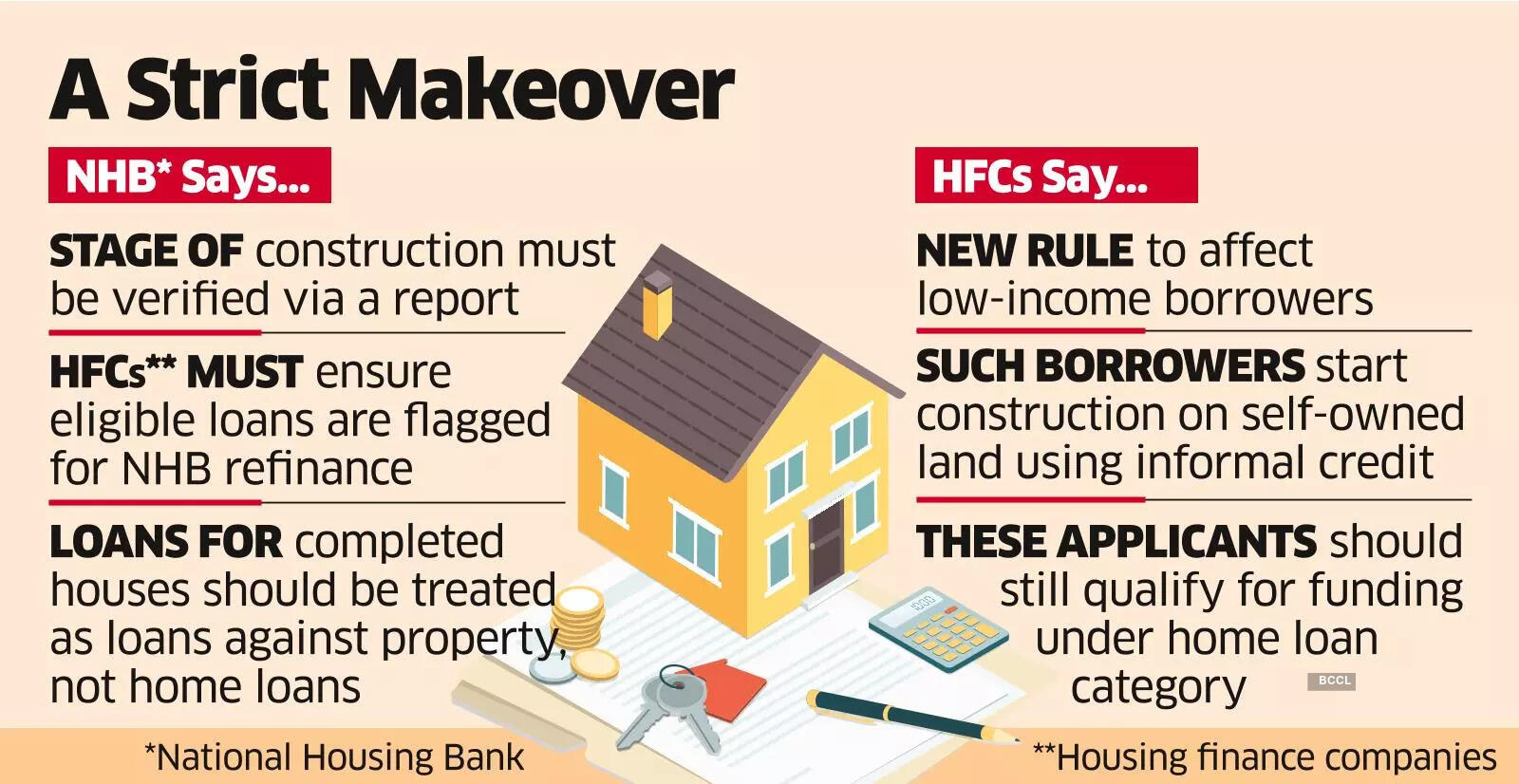

NHB stated, “For loans extended to individuals for ongoing construction, refinance will only be available when no more than half of the construction is finished at the time of the first loan tranche disbursement by the housing finance company (HFC).” A technical evaluation report must clearly verify the construction stage at this point, and HFCs are required to flag only eligible loans for NHB refinance.

Sources indicate that these changes respond to instances where borrowers applied for home loans after construction completion, effectively monetizing their properties post-construction. NHB clarified that such cases should be categorized as loans against property (LAP), not home loans.

Despite appeals from HFCs to accommodate newly built homes for home loan refinancing, NHB denied the request. “Once a house is constructed, providing a home loan is tantamount to monetizing the asset,” stated the chief executive of a housing finance company.

Many HFCs express concern that this new rule could disproportionately affect low-income borrowers, particularly those who begin construction on self-owned land using informal credit like family loans. Often, these borrowers seek HFC loans only once construction nears completion, primarily to settle previous debts. HFCs argue these applicants should still qualify for home loan funding.

As of September 2024, out of the total outstanding home loans of ₹33.53 lakh crore, housing finance companies accounted for ₹6.25 lakh crore.

The NHB has been intensifying regulatory oversight and enforcing stricter compliance measures for HFCs. Last December, it mandated that all HFCs report non-performing asset (NPA) data on the first day of each month, after noticing many lenders were still recording collections from the prior month in the following weeks. In March, the regulator reprimanded HFCs for mis-selling insurance policies linked to home loans, directing them to cease selling insurance products without transparent disclosure of terms to borrowers.