The National Housing Bank (NHB) has instructed housing finance companies to provide interest on advance payments made by borrowers that have not been immediately applied to their Equated Monthly Instalments (EMIs) and are instead held in sundry or suspense accounts, according to sources familiar with the situation.

The interest should be paid at the same rate applicable to the customer’s home loan. This initiative aims to ensure fair lending practices and prevent borrowers from incurring excessive interest costs when their advance payments are not applied promptly.

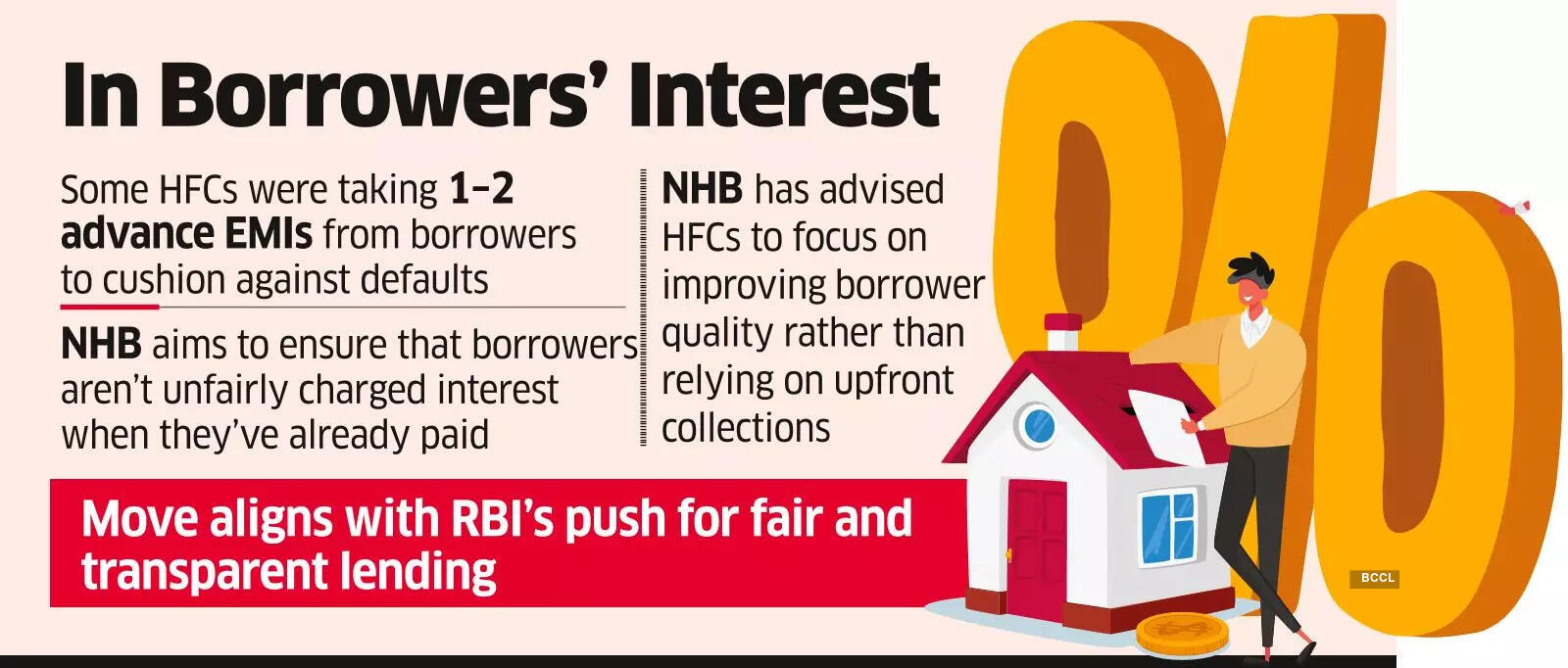

“NHB is fundamentally ensuring that housing finance companies cannot profit from holding onto customers’ advance payments,” stated the CEO of a housing finance company. “This guarantees that borrowers aren’t charged unjust interest when they have already paid in advance.”

The regulator has also urged housing finance companies to prioritize improving borrower quality instead of counting on advance collections to shield against defaults. “Some firms were accepting one or two EMIs in advance from economically weaker sections and low-income group borrowers to safeguard their financials from potential defaults,” noted a senior executive at another housing finance company. “NHB has clarified that they should either provide a lower loan amount or be ready to pay interest on the advance EMI collected.”

The NHB’s directive supports the Reserve Bank of India’s broader initiative for transparent and equitable lending practices. Last April, the RBI directed all lenders to start charging interest from the actual date of loan disbursement, rather than the date of the loan agreement execution, following inspections that uncovered discrepancies. In numerous instances, lenders were discovered charging full-month interest even if the loan was disbursed midway through, leading to increased costs for borrowers. The RBI’s intervention aimed to ensure that borrowers are only charged for the actual time their loans are active.

NHB, responsible for regulating and supervising housing finance companies, has been steadily enhancing oversight of the sector. In December 2024, it mandated that all housing finance companies report non-performing asset (NPA) data on the first of each month, revealing delays in how some lenders documented collections from previous months.

In March, the regulator reprimanded housing finance companies for mis-selling insurance policies bundled with home loans, instructing them to halt sales of insurance products without ensuring clear disclosure of terms to borrowers. In May, NHB tightened its regulations on refinancing home loans for projects under construction, stating that refinancing would only be allowed if less than half of the construction was completed at the time of the first disbursement, aiming to curb the misuse of funds and minimize risk in early-stage projects.