KOLKATA: Muthoot Microfin is currently in talks with two non-banking financial companies (NBFCs) in the micro loan against property (LAP) sector to acquire a majority stake, aiming for inorganic growth and expanding its secured lending portfolio, according to sources familiar with the matter.

The firm recently entered the micro LAP business as part of a strategy to diversify its product offerings, helping to alleviate its reliance on unsecured microfinance.

The inorganic growth would provide Muthoot Microfin with a robust foundation for expanding its micro LAP operations.

“Muthoot Microfin is considering a majority stake acquisition that would enable it to gain expertise in this sector. To engage in lending against property, it requires skilled professionals for property valuation and title assessment,” said an insider who wished to remain anonymous.

Muthoot Microfin CEO Sadaf Sayeed chose not to comment.

Non-banking financial companies and microfinance institutions (NBFC-MFIs) are adopting portfolio diversification strategies following a recent policy change by the Reserve Bank of India, which now allows them to allocate up to 40% of their portfolio to non-microfinance loans. Previously, NBFC-MFIs were limited to 15% for non-microfinance exposure.

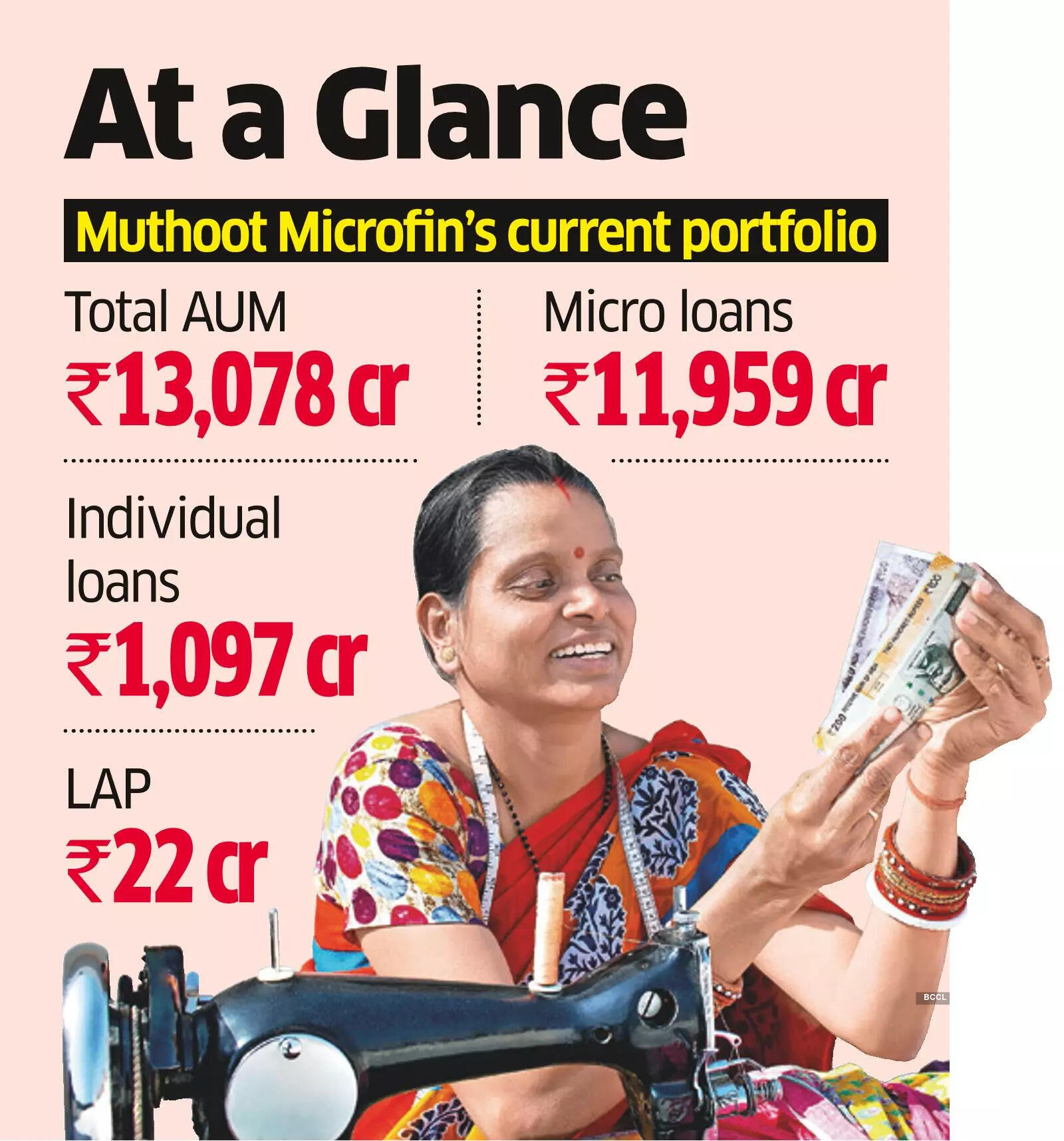

Currently, about 85% of Muthoot Microfin’s total portfolio of ₹13,078 crores consists of unsecured joint liability group (JLG) loans, with the remaining 15% in non-JLG loans.

“By the end of the next financial year, we aim for a 70-30 mix,” Sayeed stated during an earnings call on February 10. “Right now, everyone is recalibrating their operational models and strategizing for diversification.”

Muthoot Microfin manages assets totaling ₹11,959 crores in micro loans, ₹1,097 crores in individual loans, and ₹22 crores in LAP. The lender has plans to grow its portfolio to ₹14,000 crores by March’s end and targets around 20% growth for the coming financial year.

Muthoot Microfin shares fell by approximately 1.5% to 187.85 on the BSE on Tuesday, while the benchmark index saw a marginal increase of 0.2%.