MUMBAI: Housing finance companies (HFCs) are projected to report moderate earnings for the June quarter, with industry-wide loan disbursals increasing by approximately 8% year-on-year, as per analyst projections. Nonetheless, margins are expected to face pressure due to intensified competition from banks and the effects of recent interest rate cuts.

Moreover, provisioning costs may rise due to slower recovery rates, potentially resulting in stagnant profit after tax growth.

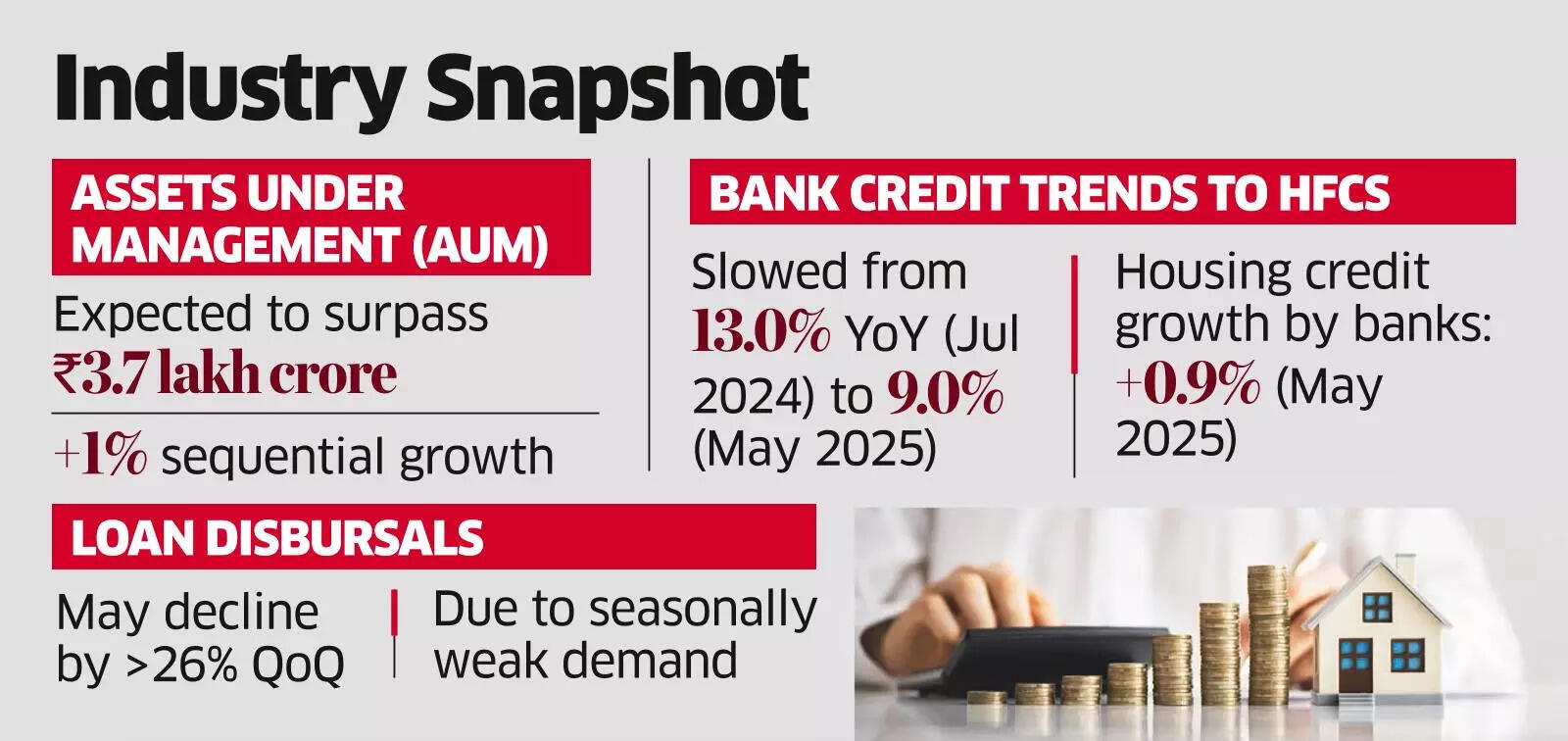

As estimated by PL Capital, HFCs’ assets under management (AUM) are anticipated to exceed ₹3.7 lakh crore by the end of the June quarter, reflecting a 1% sequential growth. However, loan disbursals could experience a decline of over 26% quarter-on-quarter due to typically weak seasonal demand.

“Bank credit to HFCs has been on the decline due to reduced demand, decreasing from a year-on-year increase of 13.0% in July 2024 to 9.0% in May 2025,” explained Gaurav Jani, an analyst at PL Capital. “Although banks’ housing credit growth was modest at 0.9% in May 2025, increased liquidity in the system might spur a slight increase in housing credit, further heightening competition for HFCs.”

Analysts predict major HFCs will report net interest margin (NIM) compression, mainly due to declining yields and intensifying competition, particularly from public sector banks.

Per Motilal Oswal, LIC Housing Finance may see a sequential margin decline of about 5 basis points, while its loan growth could be around 8% year-on-year. PNB Housing Finance is anticipated to report 16-17% year-on-year growth in its total loan portfolio, with a similar contraction of 5 basis points in NIM.

“Despite a 100 basis point reduction in the repo rate by the RBI, most affordable HFCs did not adjust their PLR rates until June 2025, which should aid margin expansion,” noted Motilal Oswal. “Asset quality for HFCs remains generally stable, barring typical seasonal trends observed in Q1. Credit costs are expected to stay benign.”

HomeFirst Finance is projected to achieve a 12% year-on-year loan growth, while Aavas Financiers may experience some margin pressure. Both firms could encounter seasonal asset quality challenges, although analysts believe credit costs will remain under control.

On the other hand, Five Star Business Finance is expected to show subdued loan growth and disbursements as the company adopts a cautious approach due to ongoing asset quality and collection challenges.