The National Housing Bank (NHB) is intensifying its scrutiny of housing finance companies (HFCs) for violating loan-to-value (LTV) norms concerning high-value home loans, according to sources familiar with the matter. Regulatory inspections by the NHB uncovered instances where loans exceeding ₹75 lakh were approved with LTVs as high as 90%, breaching the established 75% limit.

The NHB has instructed lenders to reclassify these loans as non-home loans (NHL).

“The regulator has identified several mortgage lenders disbursing substantial amounts for high-value residential properties,” an NHB official stated. “The NHB has communicated with these firms, ordering them to cease such practices and to reclassify these loans accordingly.”

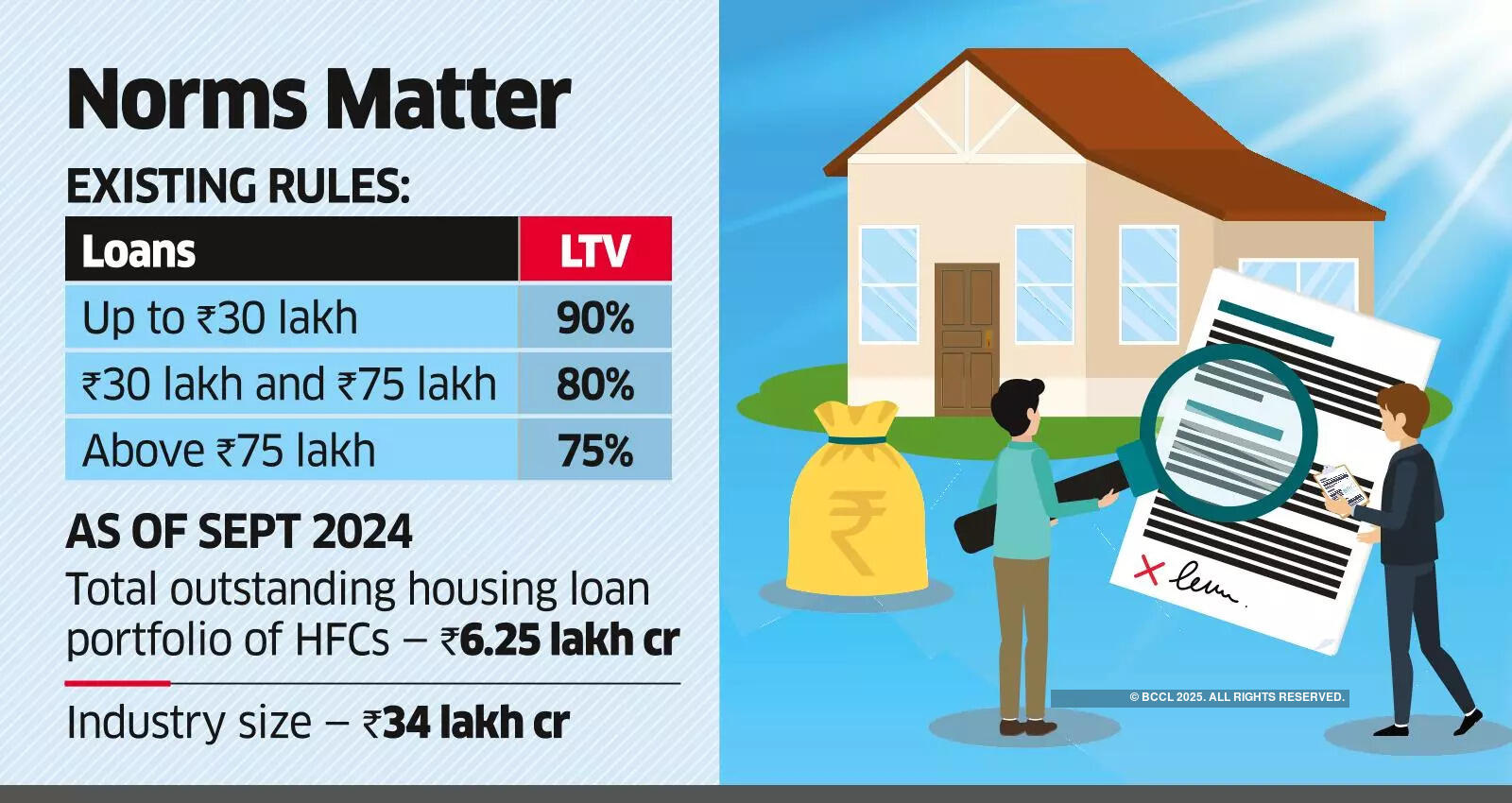

As per current regulations, loans up to ₹30 lakh can have an LTV of 90%, those between ₹30 lakh and ₹75 lakh can have an LTV of 80%, and loans above ₹75 lakh must maintain a 75% LTV ratio. The regulatory scrutiny is also affecting market transactions, with HFCs acquiring loan portfolios from other lenders now requiring explicit clarifications on whether the underlying assets are designated as home loans or non-home loans before adding them to their portfolios. “Previously, while purchasing loan pools, HFCs did not seek LTV disclosures. However, following the regulatory rigor, they now demand specific classifications for home loans and non-home loans,” noted another official.

Both the Reserve Bank of India (RBI) and NHB have been addressing lenders that disregard LTV norms. They have observed that during economic downturns, borrowers with LTV ratios above 80% are likely to encounter greater financial stress and are more susceptible to defaulting on their loans.

In December of the previous year, the RBI warned lenders against excessive exposure to all types of top-up loans, including home top-up loans, which are additional credit facilities provided against existing mortgages.

While some lenders view these loans as low-risk, they are frequently approved with insufficient due diligence, lax underwriting standards, and poor adherence to prudent norms regarding loan-to-value ratios, risk weights, and verification of end-use, as noted by the central bank.

The banking regulator cautioned that such lending practices could pose systemic risks, especially if the value of the underlying collateral fluctuates or experiences a cyclical decline. As of September 2024, HFCs had an outstanding housing loan portfolio of ₹6.25 lakh crore, compared to the overall industry size of nearly ₹34 lakh crore, according to NHB data.