Can Fin Homes has seen its stock rise nearly 22% in the last three months, with a 10% increase following the announcement of its second-quarter results on October 18. Over the same period, the BSE Financial Services index has gained more than 9%, with a 2% increase since October 18.

The housing finance company expects to boost its Assets Under Management (AUM) growth to over 15% in FY27, compared to an anticipated 12% for the current fiscal year. This growth will be driven by an expansion in Northern regions and a recovery in its current markets in the South. In the September quarter, Can Fin opened 32 new branches, increasing its total to 248.

The company is actively working to enhance its presence outside the South, where it traditionally has a strong foothold. In the most recent quarter, the share of branches and loan portfolios in the South decreased to 54% and 71%, respectively, down from 60% and 73% a year earlier. This strategy has allowed Can Fin to maintain momentum in AUM despite slower loan disbursements in Karnataka and Telangana.

“Beyond its key geographies, Can Fin is experiencing robust growth in the Eastern and Northern states, exceeding 30%, while Tamil Nadu and Western states are showing substantial growth of around 25%,” noted Axis Securities in a report. The company aims to increase the share of new disbursements in the Northern region to 40% by March 2028, up from 32% as of September 2025.

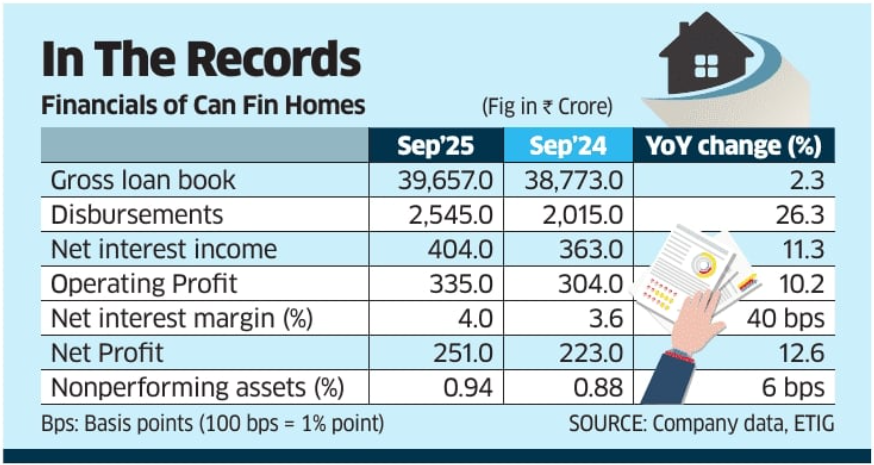

The company’s disbursements grew by 26% year-on-year and 7% sequentially to ₹2,545 crore. Growth may slow in the December quarter due to a technology transformation, although this is expected to be temporary.

The gross nonperforming asset (NPA) ratio has remained under 1% in the September quarter, thanks to lower provisioning and improved delinquency rates. “NPAs in the salaried portfolio dropped from ₹627 million to ₹372 million, reflecting improved repayment trends and asset quality,” stated Elara Capital. The brokerage expects gross NPAs to remain within 0.9-1% in the near term.

The net interest margin (NIM) rose to 4% in the September quarter from 3.6% a year earlier, aided by declining borrowing costs. Motilal Oswal Financial Services anticipates NIM will stabilize around 4% for FY26. The brokerage has raised its FY26 earnings forecast by approximately 5% due to higher NIMs and reduced credit costs. “We forecast a CAGR of around 13% in advances and net profit over FY25-28, with a return on assets exceeding 2.2%,” the report concluded, with a target price estimate of ₹915. The stock closed down 0.6% at ₹886.4 on Thursday on the BSE.