MUMBAI: An investment entity supported by Abu Dhabi’s sovereign wealth fund, ADQ, and partly owned by Sheikh Tahnoon bin Zayed al-Nahyan, is reportedly in advanced talks to acquire a minority share in Aadhar Housing Finance, which is backed by Blackstone. Sheikh Tahnoon also serves as the national security adviser of the UAE and chairs ADQ.

The proposed investment ranges from $200 million to $225 million (approximately Rs 1,750-2,000 crore) for a 10-12% equity stake in the affordable housing finance firm, which launched an IPO in 2024. A formal announcement is anticipated soon.

This follows a larger commitment by Blackstone, amounting to nearly $2 billion (about Rs 17,335 crore), in collaboration with two of its sponsors or limited partners (LPs), through reshuffling most of its existing three-fourths ownership into a new ‘continuation’ vehicle, akin to their strategy with Mphasis in 2021.

Blackstone has not disclosed details regarding the new investor. Similarly, responses from ADQ and Sheikh Tahnoon’s office remain pending.

Over the weekend, it was announced that Blackstone funds BCP Asia II Holdco VII Pte, Blackstone Capital Partners (CYM) IX, and Blackstone Capital Partners (CYM) IX AIV-FLP initiated an open offer to purchase 113.5 million shares of Aadhar, which equates to a 25.82% stake, from public shareholders at Rs 469.97 each, in compliance with regulations.

This open offer comes as Blackstone prepares to transfer about 64% of its shareholding from one set of funds to two new funds at Rs 425 per share, ensuring ongoing investment. The value of this secondary transaction is around Rs 12,000 crore ($1.4 billion). Should the open offer meet full subscription, an additional Rs 5,335 crore ($620 million) will be disclosed in cash.

JM Financial is facilitating this open offer. If fully subscribed, Blackstone may need to divest some shares to stay within the 75% non-public shareholding limit.

The stake divestment to the newly established Abu Dhabi entity is anticipated to occur at a similar valuation.

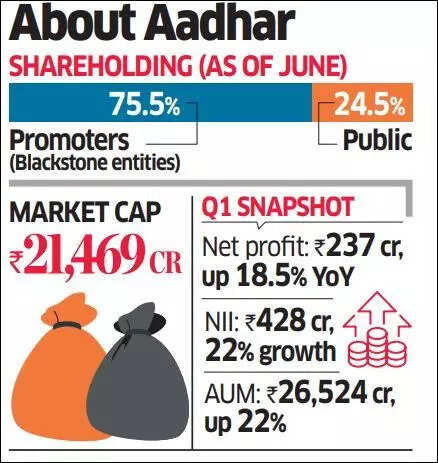

As of Friday, Aadhar’s stock closed at Rs 496.90, bringing its market cap to Rs 21,469.03 crore. The share price has risen 12.11% in the past month amid transaction expectations, showing an 18.63% increase year-to-date due to strong performance. In the first quarter ending June, the company reported a 19% jump in net profits, reaching Rs 237 crore.

Continuity funds, which allow private equity firms to transfer assets between their managed funds, are commonplace in Western markets and gaining traction in India, where firms like Chrys Capital and Multiples are employing similar structures for investments in entities like the National Stock Exchange (NSE) and Vastu Housing Finance.

According to investment bank Jefferies, buyout firms have leveraged this strategy—deemed controversial by some analysts—to exit $41 billion in investments during the first half of 2025 alone, marking a record 19% of all industry sales, a 60% increase from the previous year.

While developed markets face challenges in finding external buyers or public listings to return capital to investors, emerging markets like India present substantial growth potential for funds like Aadhar, allowing for longer durations of investment. Typically, such funds have an investment horizon of three to five years within a ten-year lifespan.

Post-IPO, multiple strategic financial entities or funds approached Blackstone regarding a complete or partial exit from Aadhar; however, transactions did not materialize due to differences in valuations, according to sources familiar with the situation.

“Blackstone has been a steadfast partner to Aadhar since 2019, significantly contributing to its development as India’s leading affordable housing finance company. This commitment facilitated a structure similar to that of Mphasis,” stated an informed executive. “The fundamentals of the affordable housing market remain robust, reinforcing confidence in continued investment and attracting high-profile new investors.”

The sector is poised for a five-year compounded annual growth rate (CAGR) of 17-18%.

The management and board will remain unchanged. Under Blackstone’s six-year ownership, Aadhar’s assets under management (AUM) have expanded to $3 billion, surpassing its nearest competitor by 1.2 times.

Aside from ADQ, Abu Dhabi possesses several sovereign investment funds, including ADIA, Mubadala, and AI-centric MGX. The emirate seeks to make substantial investments to establish itself as a global capital hub. For instance, in 2024, ADQ and Chimera Investment—part of Sheikh Tahnoon’s expansive business empire—launched Lunate, which quickly became a notable new asset manager in the region, engaging in nearly 30 deals within a year. Lunate also manages Alterra, a $30 billion climate fund, in collaboration with international firms like BlackRock, TPG, and Brookfield, with ADQ committing $6.5 billion to this initiative.