NEW DELHI: WeWork India, a flexible workspace provider, has received approval from the Securities and Exchange Board of India (SEBI) for its ₹1,000-crore initial public offering (IPO).

The Bengaluru-based co-working firm, operating under the WeWork brand, is promoted by Enam Securities in India. As per the company’s draft red herring prospectus (DRHP), the IPO consists of a fresh issue of ₹750 crore and an offer for sale (OFS) of ₹250 crore by Enam.

Once listed, shares will trade on both BSE and NSE with a face value of ₹10 each. The proceeds from the fresh issue will be allocated towards capital expansion, reducing debt, and investing in technology, among other corporate needs.

Improved Financials and Operational Momentum

The company has been recovering, decreasing its net losses while increasing revenue over the past year. For FY24, it reported ₹1,401 crore in revenue, up from ₹1,314 crore in the previous fiscal year. Net losses have significantly reduced to ₹146 crore, down from ₹286 crore in FY23.

WeWork India’s average occupancy rate has surpassed 75%, representing over 75,000 seats across major cities like Bengaluru, Mumbai, Gurugram, and Pune. EBITDA, excluding ESOP costs, has shown positive growth for the first time, indicating a path towards profitability.

On the balance sheet, total borrowings have been reduced to ₹498 crore by March 2024, down from ₹637 crore the previous year.

Strategic Vision and Fund Allocation

The company aims to utilize ₹350 crore from the fresh issue for establishing new centers and upgrading existing facilities. ₹200 crore is designated for debt and lease liability repayment, while ₹150 crore will enhance its technology stack and customer service systems.

WeWork India is focusing on AI-driven solutions, seamless digital booking, and real-time occupancy analytics to enhance service offerings. CEO Karan Virwani recently stated, “With our evolving hybrid model, we’re not just providing workspaces; we’re creating flexible ecosystems for the modern workforce.”

Portfolio Overview

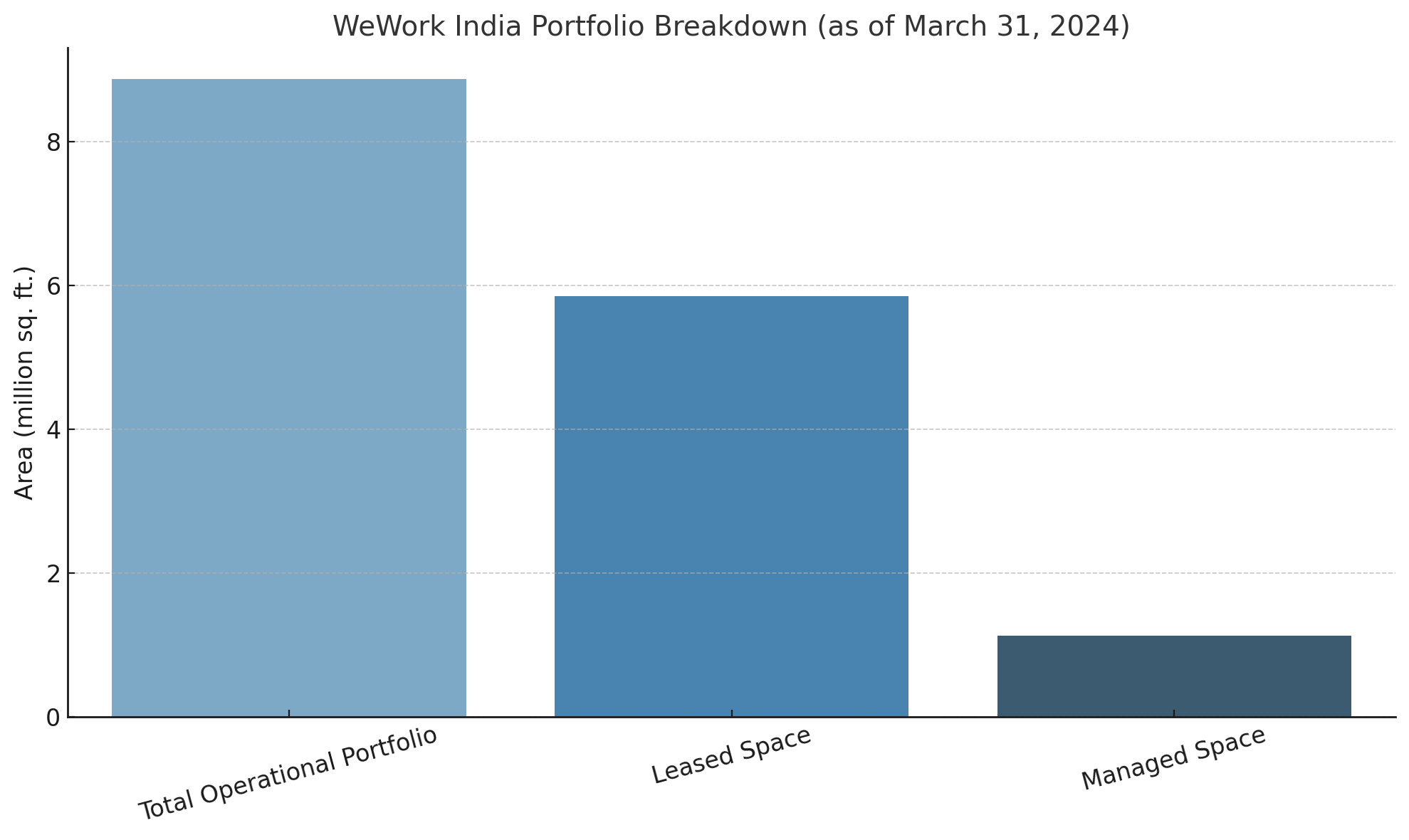

According to the DRHP, as of March 31, 2024, WeWork India has an operational portfolio spanning 8.87 million sq ft across 50 centers in nine cities.

Of this, 6.98 million sq. ft. comprises leased and managed spaces, which are critical for business operations:

- 5.85 million sq ft is leased space.

- 1.13 million sq ft operates under a managed space model (revenue-sharing arrangements).

The average occupancy rate across all operational centers was 72% for FY24, showing recovery from 64% in FY23.

Offer for Sale

According to the DRHP, the IPO’s OFS will see significant participation from key promoters and early investors. Embassy Buildcon LLP, part of the Embassy Group, plans to offload up to 5.41 crore equity shares, signaling a strategic partial exit from its investment.

Additionally, Ivanhoe Cambridge, the real estate investment branch of the Canadian pension fund CDPQ, will offer up to 4.26 crore shares through the OFS, while Bihar Hotels intends to sell up to 1.35 crore shares. In total, the OFS will consist of 11.03 crore shares, enhancing the company’s public ownership while allowing existing stakeholders an exit opportunity.

Potential Challenges

Despite its strong brand and improving metrics, WeWork India has noted several business risks in the DRHP. A major concern is the reliance on leased assets, which constitute a significant part of operational expenses. Additionally, the company faces stiff competition from other co-working spaces and real estate developers entering the flex-space market.

Its revenue is heavily concentrated in metropolitan areas, making it susceptible to regional economic fluctuations. Operational challenges related to regulatory approvals, taxation, and partner transparency could also hinder scalability.

The IPO is managed by Axis Capital, ICICI Securities, and Kotak Mahindra Capital, with legal counsel from Shardul Amarchand Mangaldas and Latham & Watkins LLP.