Realty developer Valor Estate, previously known as DB Realty, has placed the highest bid of ₹771.09 crore for Lavasa Corporation, as part of the ongoing insolvency resolution for the financially troubled hill city project near Pune. This bidding process, conducted under the ‘challenge process’ of the Corporate Insolvency Resolution Process (CIRP), ended on Tuesday.

“The highest bidder was determined after an intense series of 10 rounds,” noted an insider. “The committee of creditors (CoC) will continue negotiations with the applicant to optimize the value. Details regarding the timeline for final plan submissions and proof of funding will be provided separately.”

Other contenders included Welspun Group, Lodha Developers, Pride Purple Group, Jindal Steel & Power Group, and Yogayatan Group. Welspun’s bid of ₹750 crore came in second, with Yogayatan’s offer valued at ₹725 crore based on net present value (NPV), which assesses a project’s future profitability by discounting anticipated payments. RealtyDailyNews has yet to confirm the overall value of the bids.

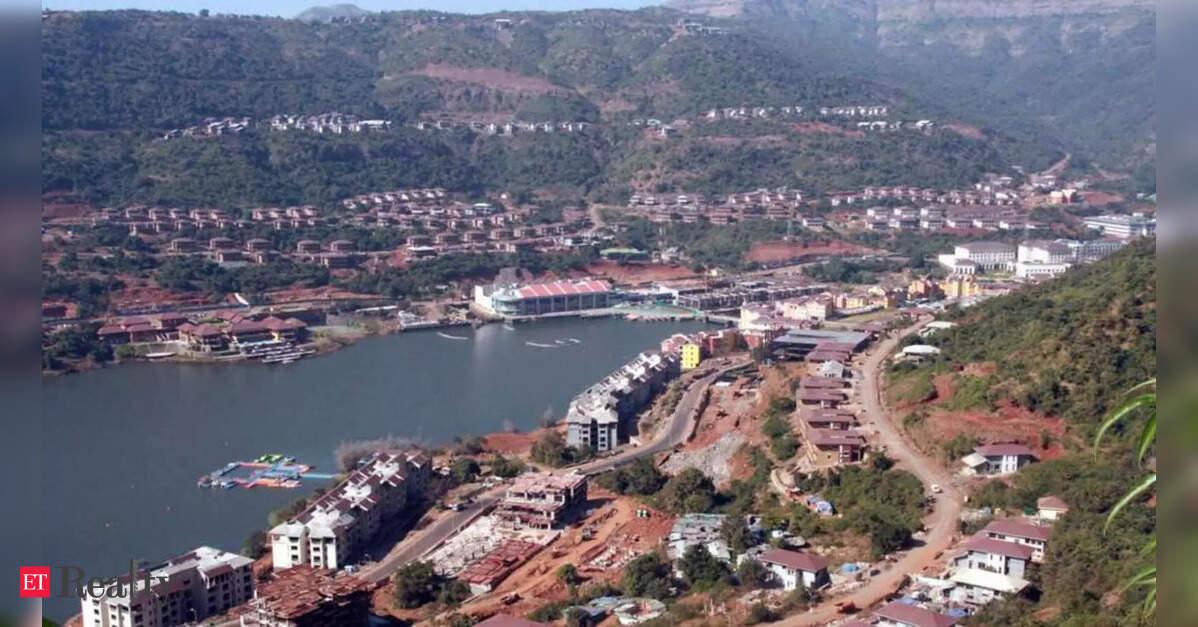

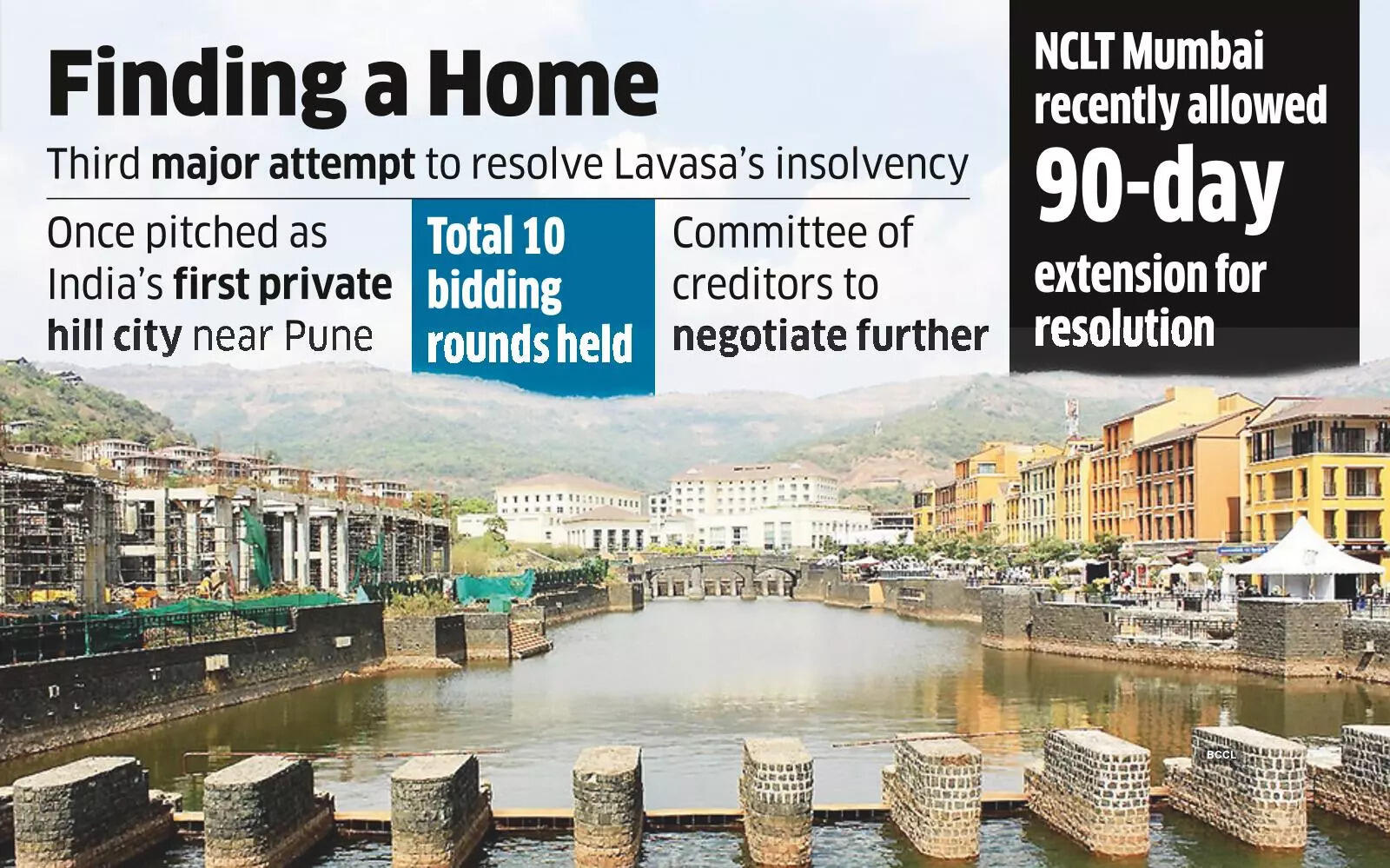

The CIRP for Lavasa was initiated under the Insolvency and Bankruptcy Code (IBC), 2016, following the company’s default on its financial commitments. Lavasa, initially envisioned as India’s first private hill city, has suffered financial troubles due to regulatory delays, halted construction, and escalating debts, amounting to over ₹6,642 crore.

As part of the CIRP, the CoC sought resolution proposals from interested parties to either revitalize the company or recoup debts through asset sales. This marks the third significant attempt to resolve Lavasa’s insolvency, following failed previous bids, including a ₹1,814-crore plan from Darwin Platform Infrastructure (DPIL) that was approved in July 2023 but did not proceed due to non-payment of the upfront amount.

“While Valor has emerged as the winning bidder, its proposal, similar to those from other competitors, is contingent upon obtaining environmental clearance (EC), which may not be favorable to lenders. Given past experiences, banks are likely to exercise increased caution this time, thus the process is far from concluded,” stated another source. The tribunal has permitted the continuation of the resolution process and allowed the CoC to exclude the period from July 13, 2021, to January 3, 2022, from the evaluation timeline.

The process stipulates a time-sensitive resolution, typically lasting 180 days, extendable by an additional 90 days under exceptional circumstances. “The resolution proposals are still in draft form and may undergo adjustments. Creditors will naturally have input,” remarked another insider, adding that the CoC is expected to convene later this week to decide on the next steps.

Email inquiries sent to EY-backed resolution professional Udayraj Patwardhan, Valor Estate, and process advisor to the lenders, BoB Capital Markets, have gone unanswered.

Given the intricate complexities surrounding Lavasa’s land titles, outstanding regulatory approvals, and environmental issues, the CoC recently requested a 90-day extension to complete the evaluation of bids, legal assessments, and final selection of a resolution applicant. Valor’s potential acquisition could signify a crucial turning point in Lavasa’s lengthy insolvency saga, potentially reviving hopes for the completion of the stalled project and its eventual transfer to homebuyers and creditors.