NEW DELHI: Macrotech Developers, renowned for its Lodha brand, has secured its position as India’s top real estate company in the 2025 Grohe-Hurun India Real Estate rankings, based on market capitalization as of March 31, 2025. With a market cap of ₹1,29,400 crore, the Mumbai-based firm continues to lead the standings, reflecting robust investor confidence and stellar performance within the Indian property sector.

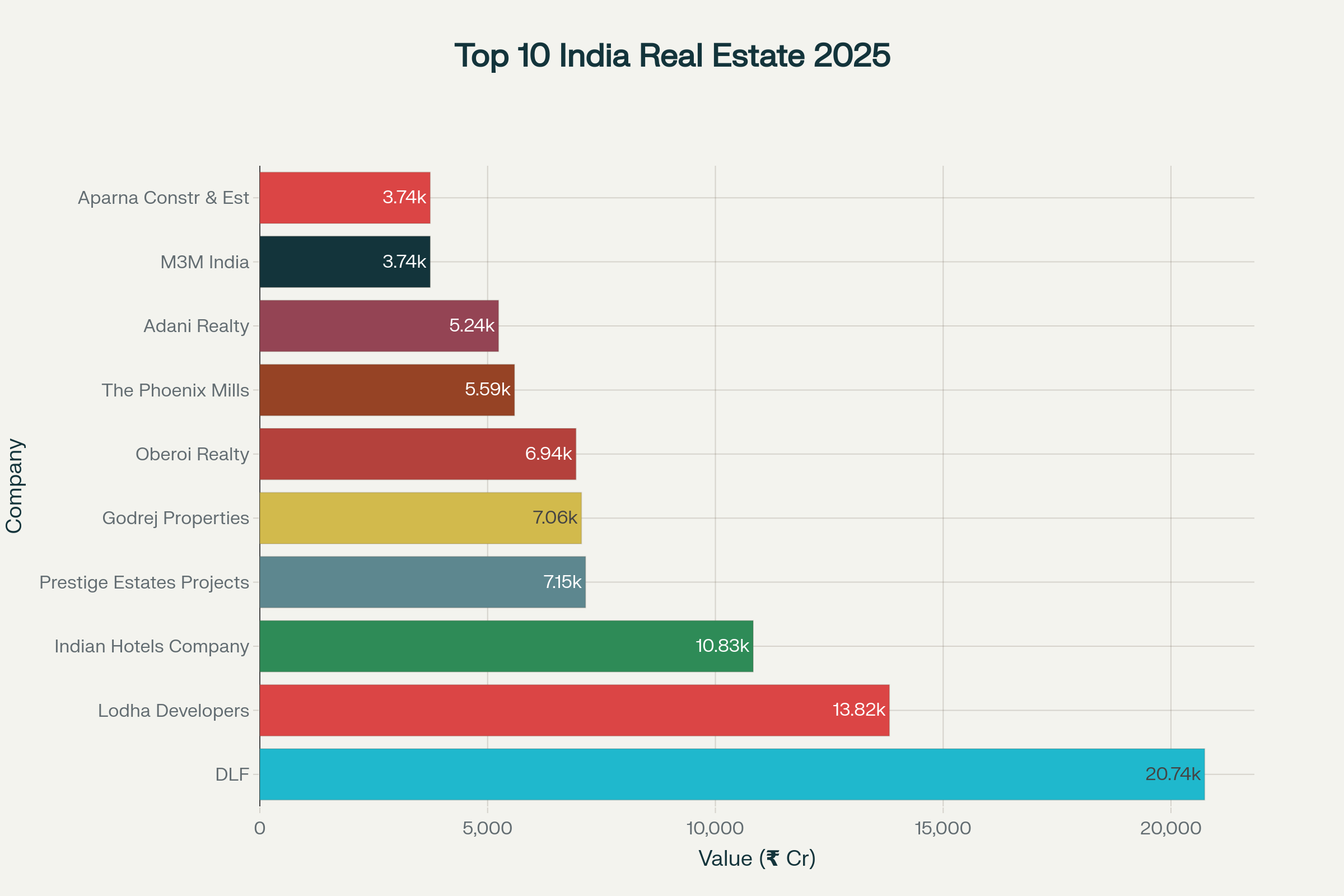

DLF follows closely with a market cap of ₹1,15,100 crore, while Phoenix Mills rounds out the top three at ₹47,800 crore. The report indicates that the total market capitalization of the 25 listed companies amounts to ₹6,12,500 crore.

Leading Wealth in Real Estate

Mangal Prabhat Lodha and his family, associated with Macrotech Developers, retain the title of the wealthiest individuals in India’s real estate sector, boasting a net worth of ₹91,400 crore. This considerable wealth underscores Macrotech’s stronghold in both corporate success and personal wealth creation, driven by substantial sales and a growing market cap in Mumbai and other cities.

Rajiv Singh of DLF ranks second with a net worth of ₹61,400 crore. DLF has maintained its strength in both the commercial and luxury residential markets, particularly in the Delhi-NCR area, keeping Singh among the industry’s elite. Notable figures such as Jitendra Virwani from Embassy Group, Vikas Oberoi from Oberoi Realty, and Atul Ruia from The Phoenix Mills also influence the sector’s landscape across various real estate disciplines.

This concentration of wealth reflects a broader trend within the Indian real estate sector, where a select few families and individuals, primarily from Mumbai and Delhi-NCR, continue to shape industry fortunes. With rising demand, urban development, and increasing REIT participation, these leaders are set to expand their wealth and influence further in the upcoming years.

Consolidation and Sector Growth

The report indicates that the top 10 companies represent 88% of the overall market cap, demonstrating ongoing consolidation within the industry. Among the 25 firms, 19 are headquartered in Mumbai, reinforcing the city’s status as India’s real estate hub.

The average market capitalization stands at ₹24,500 crore, with a minimum threshold of ₹3,700 crore for inclusion in this list.

Noteworthy Changes

Seven companies have improved their rankings compared to the previous year. Notably, Sunteck Realty and Signature Global climbed two positions, landing at 12th and 17th place respectively. Phoenix Mills exceeded Prestige Estates to secure third place. Additionally, three new entrants—Man Infraconstruction, Ganesh Housing, and APL Apollo Tubes—joined the rankings, collectively valued at ₹15,900 crore.

The report highlights that 17 of the 25 companies observed a growth in market capitalization over the past year, while seven faced declines and one remained steady.

Highest Revenue Growth

Among the listed developers, Signature Global reported the highest revenue growth with a remarkable 72% year-on-year increase, driven by strong demand in the affordable housing sector of NCR, particularly in Gurugram. Following close behind are Godrej Properties with a 68% increase, and Sunteck Realty with 60%, indicating a healthy pipeline of launches and improved sales conversion. These figures illustrate the strong demand for branded residential offerings amid the growing urban housing market.

Top Builders by Developed Area

DLF stands out as the leader in total developed area, covering 209 million sq ft, followed by Macrotech Developers at 95.7 million sq ft, and Prestige Estates at 85 million sq ft. These metrics not only showcase historical development but also reflect future potential and land holdings, indicating operational scale across residential, commercial, and mixed-use properties.

Debt Reduction Leaders

Leading the charge in debt reduction, Macrotech Developers successfully trimmed its debt by ₹4,800 crore, followed by Godrej Properties with a ₹890 crore reduction, and Brigade Enterprises at ₹800 crore. These efforts are part of a broader strategy aimed at strengthening balance sheets, showcasing improved cash flow management and cost optimization in the post-pandemic environment.

Lowest Debt-to-Equity Ratios

Among the listed companies, Godrej Properties reported the lowest debt-to-equity ratio at 0.1, with Phoenix Mills and Prestige Estates close behind at 0.2. This suggests strong financial discipline and an ability to finance growth through internal resources rather than relying on high levels of debt, a trend increasingly appreciated by investors and rating agencies.