MUMBAI: Efforts to strengthen the law against benami transactions are underway. These transactions often see faceless individuals, slum residents, and impoverished laborers in tribal areas holding properties worth crores for the actual owners who conceal their identities.

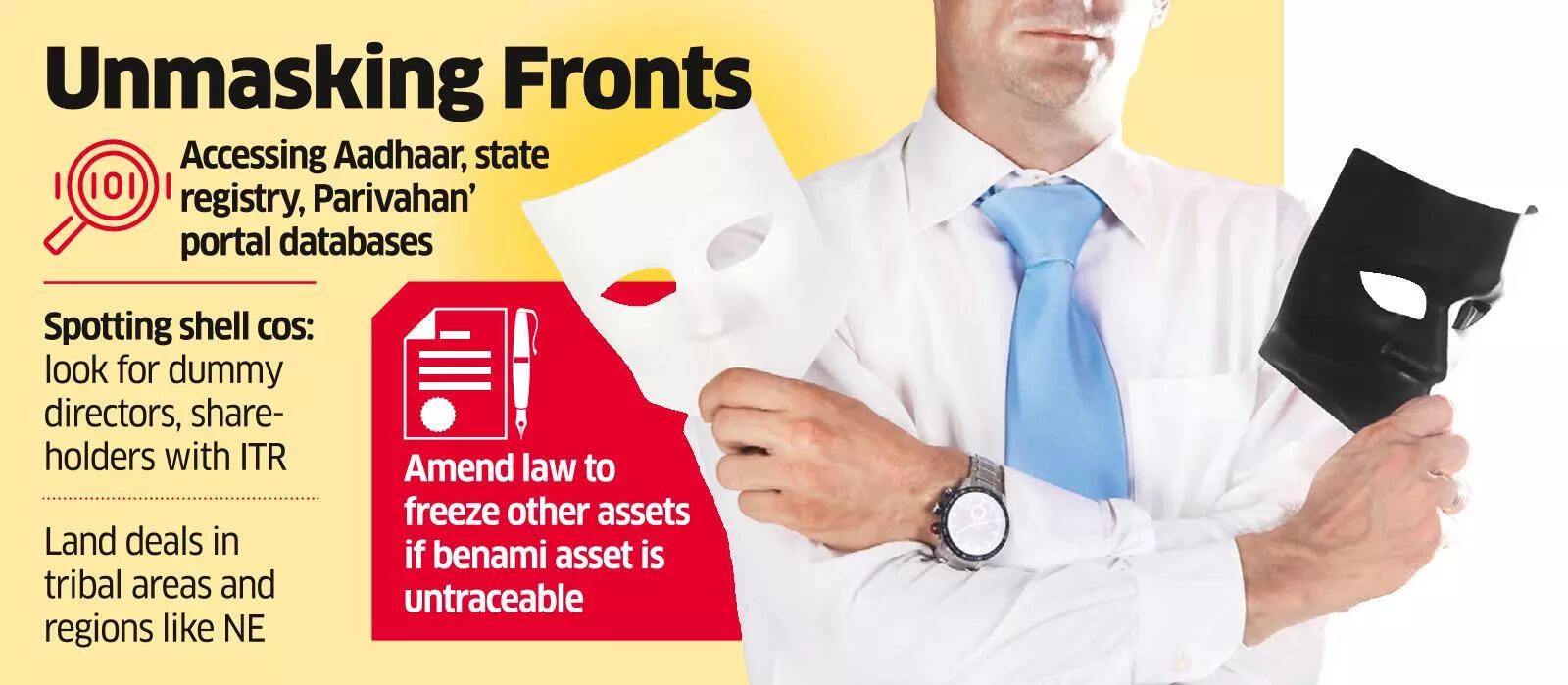

A committee formed by the Central Board of Direct Taxes (CBDT) has put forth recommendations, including granting officials access to the Aadhaar database, state property registries, and the vehicle and driving license data. They also propose amending the law to allow the confiscation of other assets belonging to true beneficiaries if a benami asset remains untraceable.

The committee, which submitted its report recently, suggested identifying ‘dummy directors’ linked with ‘shell companies’ that hold benami assets. Tax officials should investigate entities where a significant portion of directors lack income, the majority of shareholders do not file tax returns, and unsecured loans significantly exceed share capital.

In benami transactions, one individual pays for a property while the purchase is registered under the name of another person or a fictitious entity.

Issues with Benamidars Lacking PAN and Bank Accounts

The report advocates linking the I-T department’s ‘Insight’ portal with the Aadhaar database. By associating vital information like PAN, bank accounts, property purchases, and demat accounts with Aadhaar, officials can better access data. However, identifying people through ‘Insight’ is challenging if they do not have PANs. Many ‘benamidars’ lack PANs, particularly farmers without formalized accounts. Property documentation for values below ₹30 lakh may also exclude PAN details.

The report emphasizes the importance of accessing Aadhaar data via the Insight system for benami processing units. To address privacy concerns, access could be restricted to ‘view-only’ details of Aadhaar-linked property and bank account information, enabling insight into accounts missing PAN in their KYC documentation.

Ashish Karundia, founder of Ashish Karundia & Co, remarked that although the proposed law may seem severe, it aims to close existing loopholes and clarify ambiguous interpretations. “These initiatives support the digitization of land records and the integration of data from various agencies,” he noted. The Prohibition of Benami Property Transactions Act, 1988, was effectively enforced on November 1, 2016.

The report advises the sharing of tax records related to additions under Sections 68 (unexplained cash credits), 69 (unexplained investments), and 69A (unexplained money) with the Benami wing, particularly in cases where the first appellate authority has validated such additions. This data sharing may pose challenges for taxpayers,” added Ashish Mehta, a partner at Khaitan & Co.

Targeting Shell Companies

The committee has outlined several proposals:

- States must provide mandatory access rights for downloading property documents;

- Utilize real-time reports of suspicious transactions flagged by Financial Intelligence Units to identify mule accounts;

- Profile holders of private vault accounts, as some may serve as benamidars;

- Monitor cryptocurrency transfers.

Shell companies have become a primary focus for the Income Tax Department. Information obtained from investigations into entry providers has been disseminated, although standard approaches under sections 68, 69, and 69A of the I-T Act often lead to favorable judicial precedent for taxpayers, benefitting both legitimate individuals and wrongdoers. A revised policy should avoid granting blanket powers, with the proposed I-T Act 2025 aiming for consistent disclosure norms to better track benami transactions through reporting requirements.