Axis Bank to Sell ₹511-Crore Lavasa Corp Debt

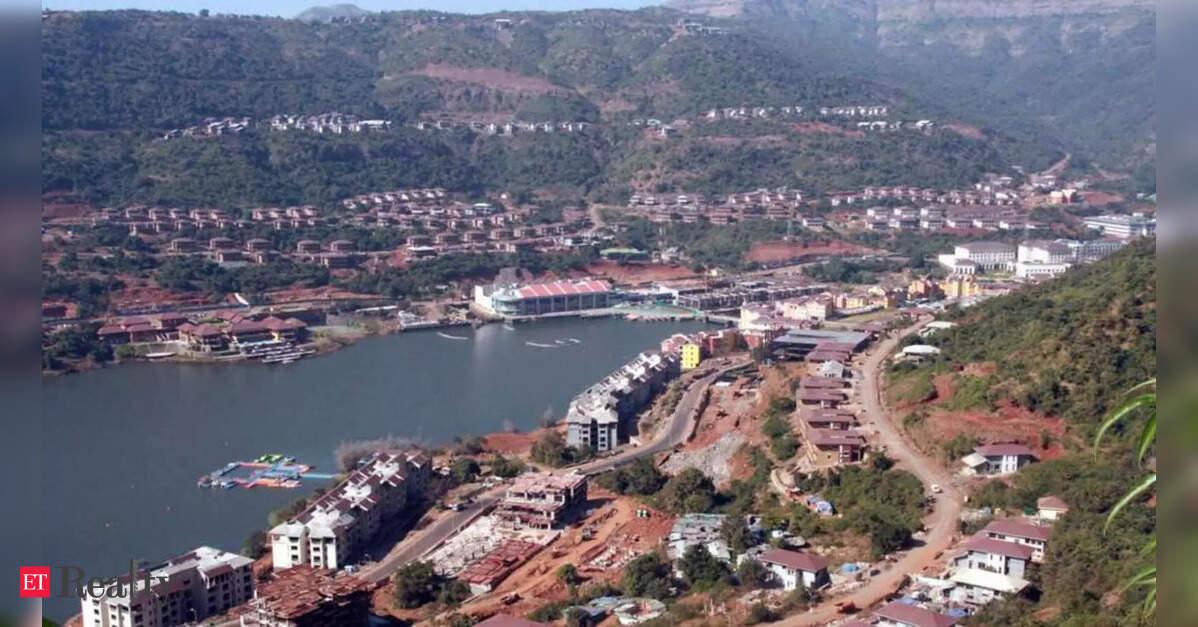

Axis Bank has become the first creditor to seek buyers for its outstanding exposure to the financially troubled Lavasa Corp, while other lenders are still evaluating their options due to the ongoing litigation issues tied to the resolution process. On Monday, Axis Bank listed its ₹511 crore claims for sale with a reserve price of ₹80 crore, available on an all-cash basis. As the fifth-largest creditor to the distressed private hill city, Axis is actively soliciting expressions of interest (EoIs) from asset reconstruction companies (ARCs), non-banking finance companies (NBFCs), and other financial institutions. The deadline for submitting documents is November…