MUMBAI: The Shapoorji Pallonji (SP) Group plans to raise $2.5 billion (approximately ₹22,000 crore) in the first quarter of the next calendar year to retire expensive existing debt. The infrastructure conglomerate has begun discussions with current investors to determine whether they prefer repayment now or at the scheduled maturity in April.

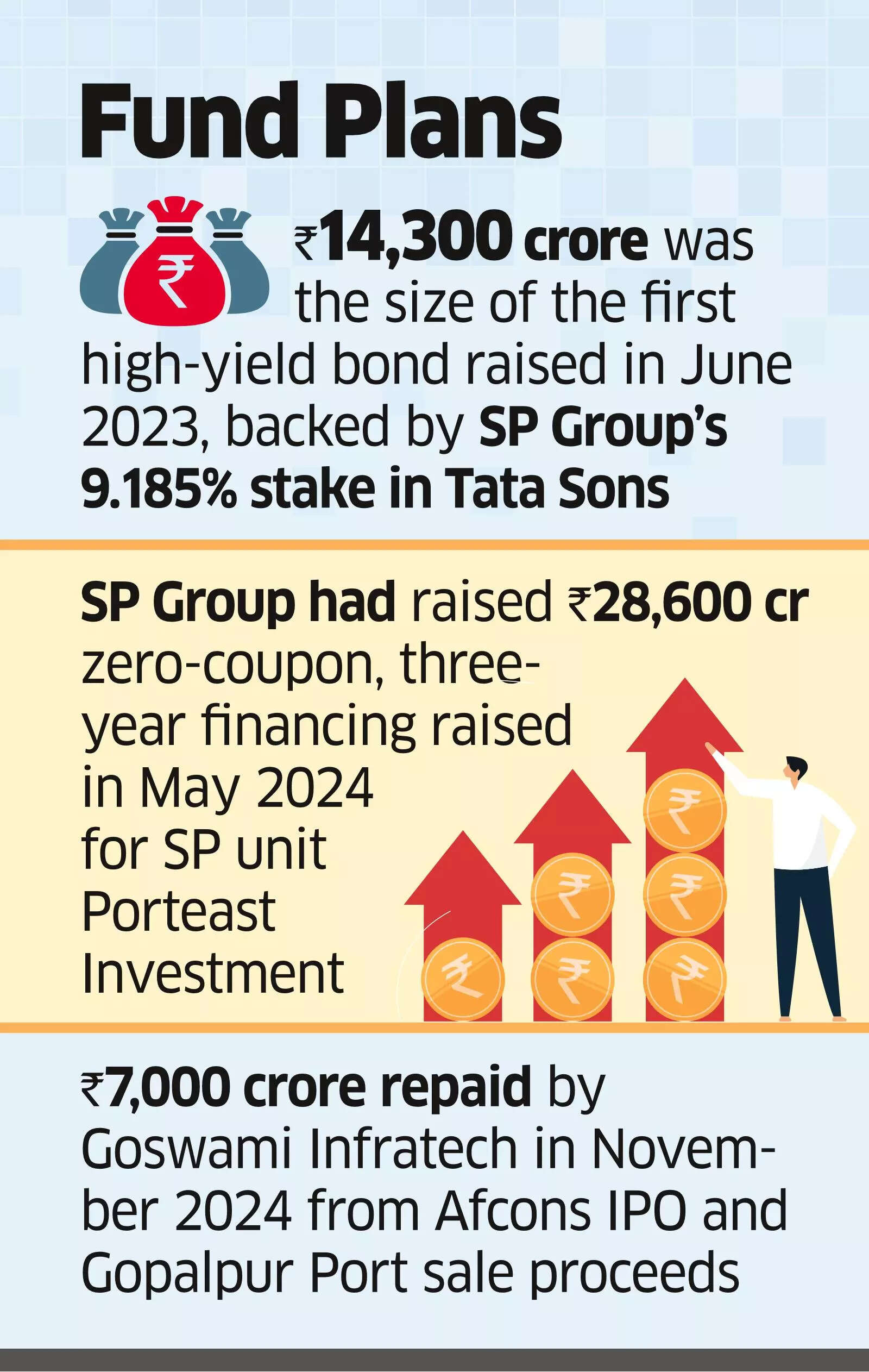

The fundraising goal aims to eliminate $1.7 billion (₹15,000 crore) of existing high-cost debt and is seen by analysts as the second phase of a capital restructuring for the group entity, Goswami Infratech.

“Refinancing is step two, which is the Q1 event,” said an insider. “Step one involved the amendment exercise, allowing investors to express preferences for repayment in December or to continue their investment.”

To this end, the group is reaching out to investors with revised terms regarding existing bonds.

Initially set for optional repayment in December 2025, they are now proposing to synchronize the optional redemption date with the final maturity in April 2026. The Goswami facility, which was established in June 2023 with an 18.75% yield, saw partial repayment through funds raised from Afcons’ listing and the monetization of port assets such as Gopalpur and Dharamtar Ports.

Approximately $1.7 billion (₹15,000 crore) remains outstanding.

Deutsche Bank, which arranged the Goswami financing in 2020, is supporting the transaction to ensure repayment for investors who choose to exit. The SP Group is finalizing its repayment and refinancing strategy.

“There are no changes to terms or covenants; it’s merely aligning the option date with maturity,” a source stated. “Investors have the choice to get repaid or stay invested.”

The Goswami bonds enjoy widespread ownership among global funds, including major investors like Deutsche Bank, Cerebrus, Varde, Farallon, and Davidson Kempener, who participated in earlier tranches.

In May, the infrastructure conglomerate raised $3.35 billion through three-year non-convertible debentures (NCDs) with a 19.75% yield, compounded annually and payable at maturity. This debt was secured by SP Group’s 9.2% stake in Tata Sons, held through Sterling Investment, its real estate arm, Shapoorji Pallonji Real Estate, and SP Energy, the oil and gas division.

The SP Group owns an 18.37% stake in Tata Sons, the unlisted holding firm for India’s most valuable conglomerate, Tata Group. The value of SP Group’s stake in Tata Sons, based solely on its holdings in publicly listed Tata Group companies, exceeds ₹3 lakh crore ($35 billion).