MUMBAI: The Supreme Court has put a hold on a goods and services tax (GST) demand linked to a joint development agreement (JDA) for a real estate project, a ruling that could significantly affect real estate developers and landowners nationwide. JDAs are commonly used as they permit developers to access land without making an upfront payment.

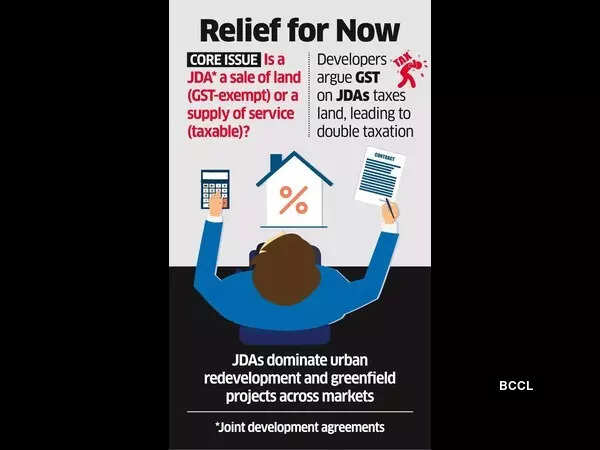

Authorities are attempting to categorize the transfer of land development rights under JDAs as a taxable ‘supply of service’ according to GST regulations. Developers contest this classification, asserting that the agreement fundamentally involves a ‘transfer of land’, which falls outside the GST framework.

A Supreme Court bench comprising Justices Aravind Kumar and R Mahadevan recently issued a stay on an assessment order from January 27, 2025, by the CGST and Central Excise, Nashik-I division against Arham Infra Developers and its affiliate Nirmite Buildtech.

The Court has sent notices to the central government and other parties involved in the developer’s special leave petition, scheduling the next hearing within four weeks of the order delivered on October 13.

The Supreme Court’s interim order has reignited discussions regarding the tax implications of JDAs.

Legal experts highlight that the core issue revolves around the treatment of land transfers under GST.

“Essentially, a JDA is a structured means for transferring land interests,” stated Abhishek A Rastogi, founder of Rastogi Chambers. “Legally, the sale of land is exempt from GST. When a landowner contributes land to a development project, the essence of the deal remains in the transfer of land or land rights.”

Rastogi indicates that the mere occurrence of deferred compensation in the form of constructed units does not change the fundamental nature of the transaction into a ‘supply of service.’

He argued that attempting to impose GST on development rights effectively imposes a tax on the land component indirectly, undermining legislative intent and leading to double taxation, especially since these units are taxed again upon sale.

This case is significant for the broader real estate sector, as joint development agreements are prevalent in urban redevelopment and greenfield projects nationwide.

The Supreme Court’s move suggests ongoing judicial scrutiny regarding GST application to JDAs. In August, the Goa bench of the Bombay High Court ruled that no GST is owed once ownership of land is transferred to the developer, clarifying when tax liability arises in such agreements.