MUMBAI: Real estate stocks experienced a decline on Wednesday, marking a third consecutive session of losses. Investors took profits amidst concerns over slowing demand.

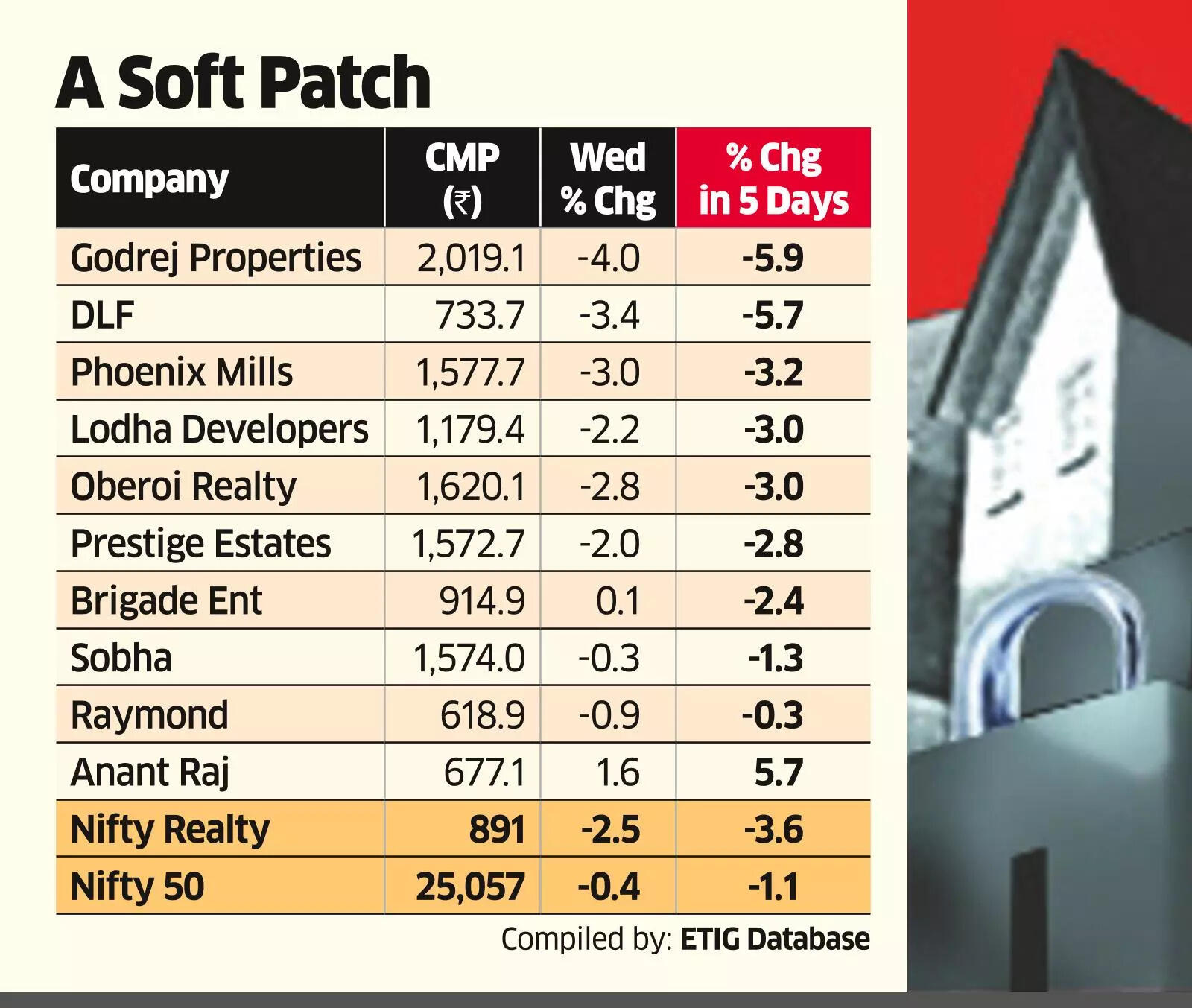

The realty index dropped by more than 2%, accumulating a total decline of 3.5% over the past three days, in contrast to a 1.1% dip in the benchmark Nifty.

Out of the 10 stocks in the index, eight recorded losses on Wednesday. Godrej Properties fell by 4%, while DLF and Oberoi Realty decreased by 3.5% and 2.8%, respectively. Lodha Developers and Phoenix Mills each saw declines of over 2%.

“Profit-taking in realty stocks follows last year’s significant rally as real estate demand has turned sluggish, while supply remains robust,” commented Dharmesh Kant, head of research at Cholamandalam Securities. He warned that additional declines of 5-7% could occur. He noted that new launches in the premium segment have been limited after last year’s exuberant demand, and mid-tier real estate players are also experiencing subdued business,” he explained.

Over the past five years, the Nifty Realty index has surged 325%, compared to a 127% gain in the benchmark Nifty, with 35% of those gains coming in 2024 when the Nifty rose by 8.8%. However, the index has fallen 14.4% so far in 2025, in contrast to a 5.5% increase in the benchmark.

“As broader markets face a pullback, selling pressure on these stocks has intensified due to position unwinding,” stated Ruchit Jain, head of technical research at Motilal Oswal Financial Services.

In the last month, the realty index has dropped by 2.8%, whereas the Nifty has seen a modest rise of 0.4%.

“Although some realty stocks did experience price increases, trading volumes were low,” Jain remarked. “Conversely, elevated volumes during declines suggest a bearish sentiment.”

“The outcome on tariffs is expected by November-December, so volatility is likely to persist until then,” Kant added.