A recent proposal to liberalize India’s foreign loan framework includes a change long resisted by former Reserve Bank of India (RBI) governors. This involves allowing external commercial borrowings (ECBs) in the real estate sector, a move that has faced opposition since the Asian Financial Crisis of 1997, which was partly fueled by foreign currency debts linked to property. Past RBI governors have remained cautious about the risks of foreign investments in the real estate market due to the financial turmoil in countries like Thailand, South Korea, and Indonesia.

A detailed look at RBI’s draft ECB policy shows a willingness to permit ECBs for all real estate projects that qualify for foreign direct investments (FDI). Therefore, if a project is eligible for foreign equity, it can also attract foreign loans.

While FDI can be accessed with lower barriers for smaller projects, ECBs are primarily available for larger ones like industrial parks, integrated townships, and special economic zones (SEZs).

The new draft policy has the potential to change this framework. It specifies that ECBs will not be applied to ‘real estate business and construction of farmhouses, except in sectors permitted for FDI.’

‘Real estate business’ usually pertains to property trading, with buying and leasing activities. The draft policy indicates that ECBs could be authorized for any project (including real estate) that qualifies for FDI. A uniform guideline across industries suggests that ECBs are permissible if FDI is also allowed. This approach is now aimed at extending to real estate.

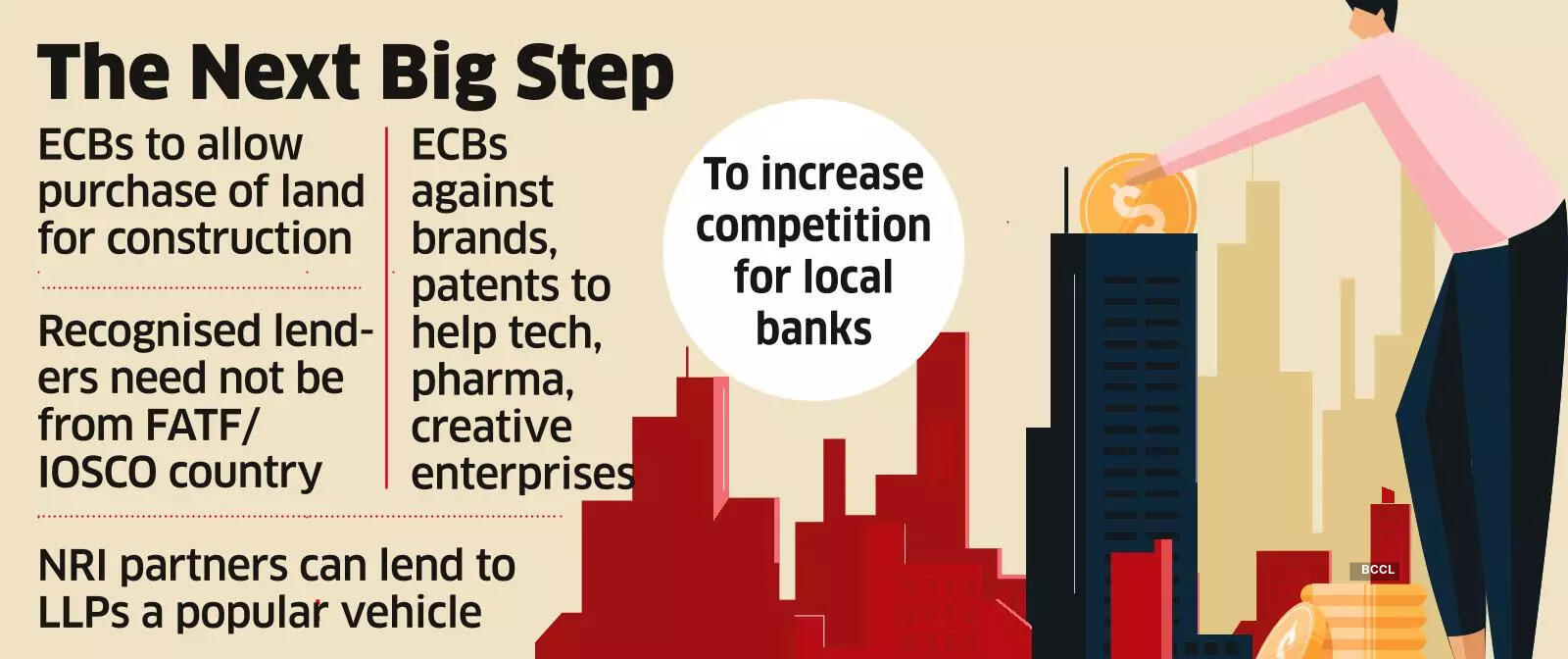

What has prompted this regulatory shift? Aside from backing a labor-intensive sector, the principal motive appears to be stabilizing the rupee through increased dollar liquidity. Facilitating ECBs could rapidly enhance dollar inflow amid foreign portfolio investor sell-offs and export pressures due to high tariffs. Additionally, it’s likely that authorities believe the real estate sector has matured enough to manage associated risks—regulatory frameworks like RERA and REITs have strengthened the market, although some dissent still exists over practices like cash transactions and hints of market bubbles. Lastly, a significant unseen factor is likely the growing influence of large corporations engaging in major real estate ventures and mergers, which could lead to relaxed lending standards. Presently, lenders must be from nations adhering to FATF (the global anti-money laundering body) or IOSCO (which regulates securities and futures markets globally). However, the draft policy redefines a “recognized lender” simply as “a person resident outside India.”

Boost for Numerous Businesses

Nonetheless, the anticipated alterations could significantly benefit various businesses. “Currently, banks are unable to extend loans to private developers for land purchases, even if intended for commercial or residential projects. Consequently, builders often enter Joint Development Agreements with landowners as an alternative funding method. The suggested changes would allow the use of ECBs for acquiring land designated for such projects,” explained Pankaj Bhuta, founder of P. R. Bhuta & Co., which specializes in tax and forex regulations.

Additionally, limited liability partnerships (LLPs) could potentially borrow from NRI partners, as the draft hints at granting LLPs access to ECBs, noted Isha Sekhri, partner at Isha Sekhri Advisory LLP, a chartered accountant firm.