MUMBAI: The promoter of Jaiprakash Associates (JAL) has re-entered the competition to reacquire control of the heavily indebted infrastructure company with a new ₹18,000 crore resolution plan, although lenders are skeptical about the previous owner’s capacity to raise the necessary funds.

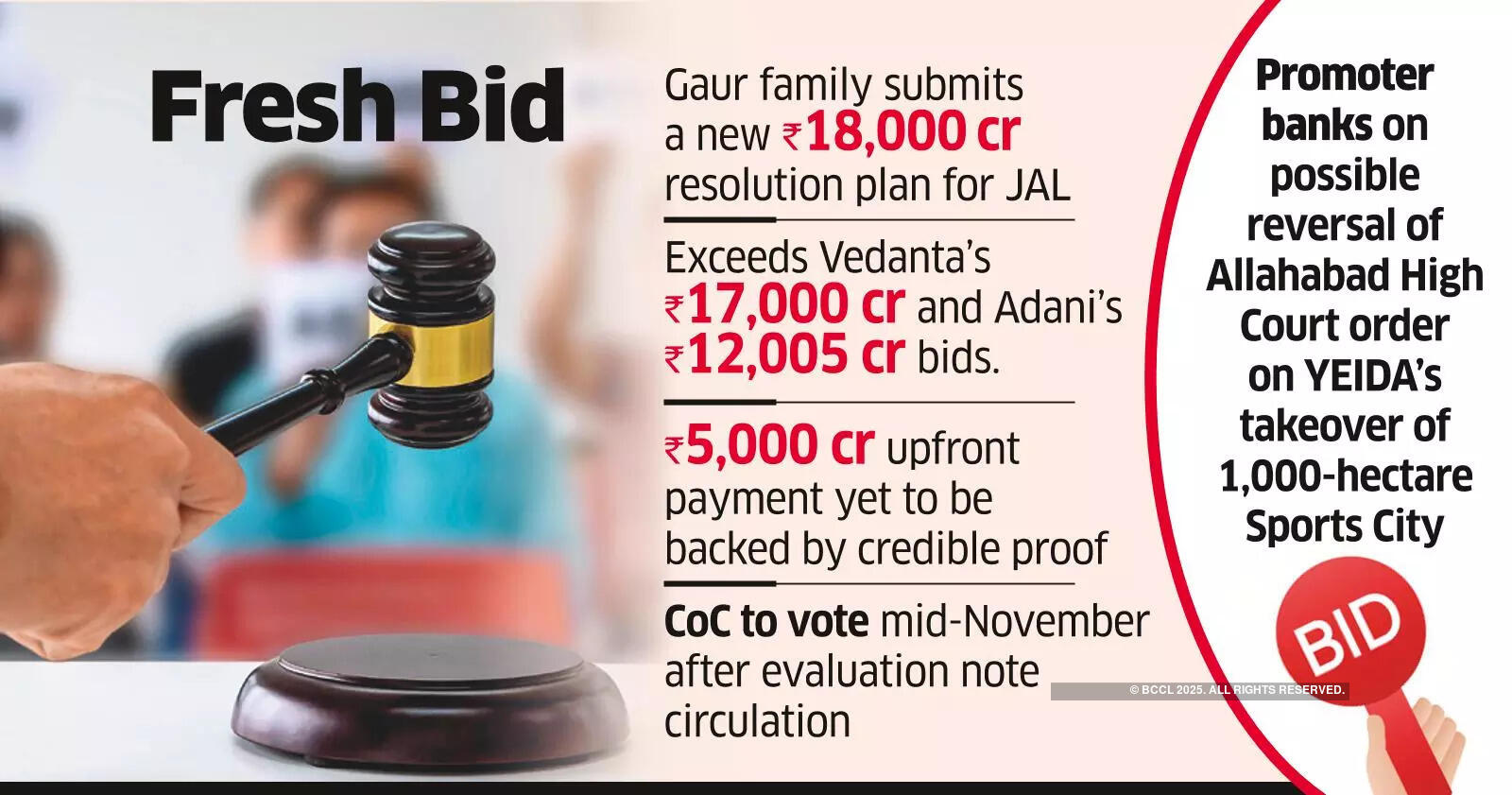

The latest proposal from the Gaur family, the promoters of Jaypee, surpasses offers made by Vedanta and the Adani Group for JAL, which holds significant land assets around Greater Noida and the Noida Expressway.

“The promoter has submitted a new plan valuing the business at ₹18,000 crore, exceeding Vedanta’s offer,” said a source with knowledge of the situation. Vedanta currently leads with a ₹17,000 crore bid, presenting a net present value of about ₹12,505 crore and an upfront payment of ₹4,000 crore, while Adani’s bid stands at ₹12,005 crore.

All proposals will be voted on next month. Although the promoter’s offer has improved significantly, concerns about funding certainty persist, as lenders have requested evidence of the proposed ₹5,000 crore upfront payment.

“There is still no clarity on the source of the funds,” noted another insider. “The promoter has been asked to provide proof of financing before the plan can be taken seriously.”

The Committee of Creditors (CoC) is currently assessing five bids, although the competition has effectively narrowed to Vedanta and Adani. Both have revised their proposals, with Vedanta leading in terms of overall recovery and upfront cash, which carries greater weight in the lenders’ evaluation. The CoC is set to circulate its assessment report early next month, with voting expected around mid-November.

The promoter’s plan could enhance recoveries if supported by credible financing. Additionally, he is hopeful for a potential overturn of an unfavorable ruling concerning land parcels and the Yamuna Expressway Industrial Development Authority (YEIDA), which could unlock ₹7,000-8,000 crore in value, according to the source.