MUMBAI: Non-bank lenders are urging the central bank to reconsider certain regulations, including risk weights for products like loans against property (LAP). They argue that the risk profiles of these assets do not warrant being categorized alongside unsecured loans or standard mortgages.

According to one source familiar with the matter, “Losses on LAP are considerably lower than those on housing loans, primarily due to heightened transaction risks in housing finance.” They feel risk weights for LAPs should be reduced or, at the very least, aligned with those of housing loans.

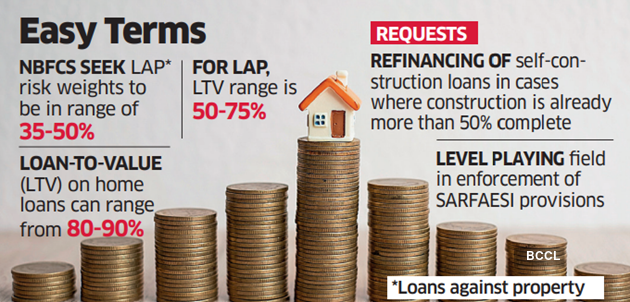

In discussions with the Reserve Bank of India (RBI), non-banking financial companies (NBFCs) have requested that LAPs not be treated the same as unsecured loans with respect to risk weights. They propose lowering the current cap of 125% to align more closely with housing loans, which have risk weights between 35% and 50%.

“There is no reason to equate the risk weights for LAP with those applied to personal or unsecured business loans,” the official emphasized. Additionally, NBFCs would like loan-to-value (LTV) ratios for LAPs to be standardized with home loans. Presently, LTVs for home loans can vary from 80-90%, while for LAPs they range from 50-75%.

NBFCs also seek permission from the RBI to refinance self-construction loans when construction is already over 50% complete.

No Execution Risk

“Loan against property is a safer business compared to home loans as it is secured by completed properties, whereas home loans are often subject to completion risk if the property is still under construction,” stated another official. “With LAP, the title deed is available upfront, while for home loans in regions like Delhi-NCR, it may only be executed upon project completion, posing risks if the project is delayed.”

NBFCs have also urged the RBI to create a fairer environment for the enforcement of SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) provisions.

Currently, housing finance companies (HFCs) can invoke SARFAESI for loan exposures over ₹1 lakh, while for NBFCs, the threshold is much higher at ₹20 lakh. Industry insiders claim this puts NBFCs at a disadvantage and have requested that the ₹1 lakh threshold be uniformly applied. They argue that at a minimum, LAP loans from NBFCs should meet the ₹1 lakh eligibility for more effective recoveries.

NBFCs are also requesting a reevaluation of the computation method for principal business criteria (PBC), proposing that it be based solely on loan assets rather than total balance sheet size.