India’s real estate sector is undergoing significant institutionalisation, with a surge in participation from investors, developers, and funds. This trend culminated in a record September quarter, marked by the highest-ever quarterly deal volume and value.

Increased interest from domestic and global institutions, exemplified by a series of large mergers, acquisitions, and listings, underscores a growing confidence in the sector’s stability and earnings potential.

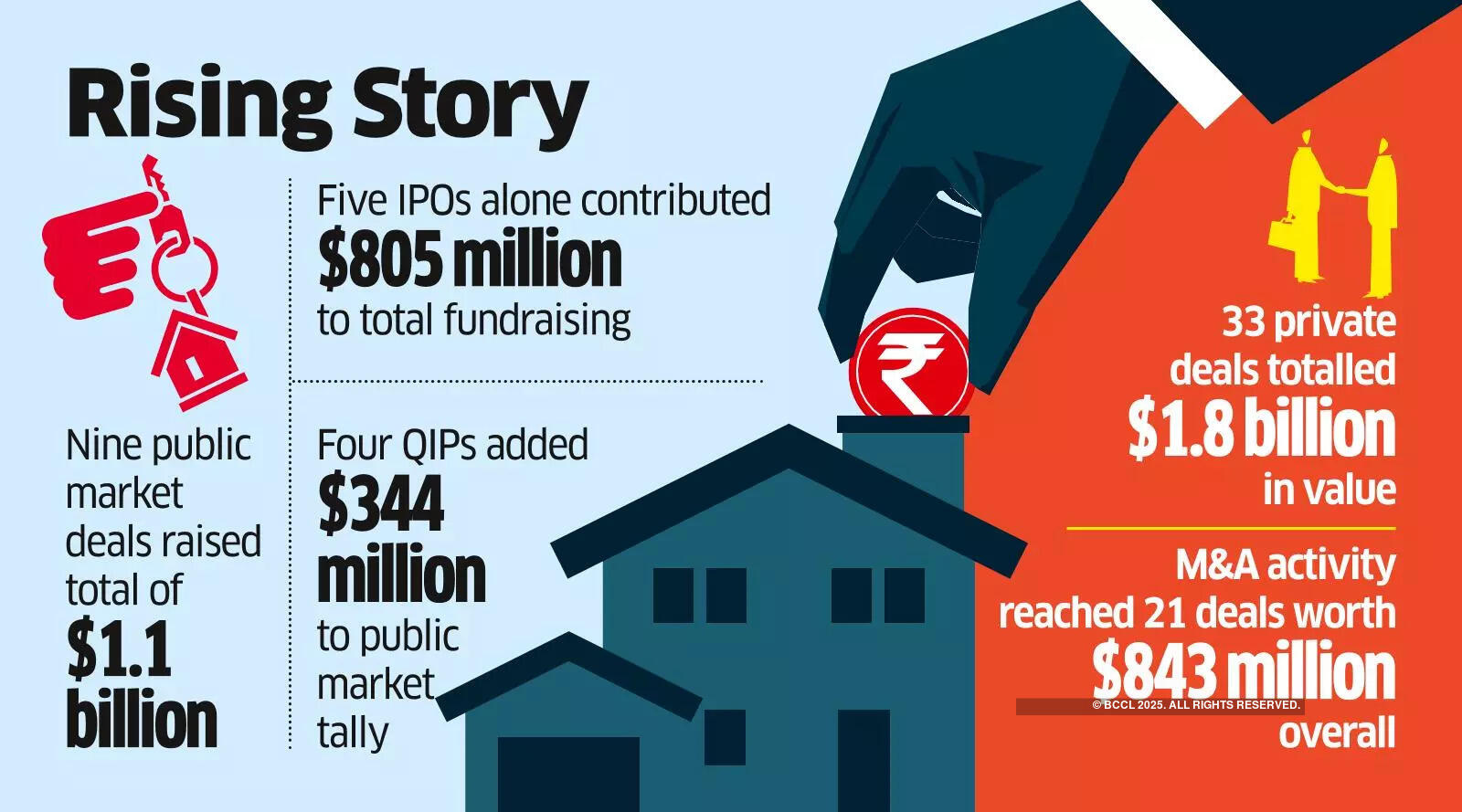

According to Grant Thornton Bharat, the sector achieved a remarkable 42 transactions valued at $2.9 billion during the quarter, representing the highest quarterly deal volume to date. This included nine public market transactions: five initial public offerings (IPOs) and four qualified institutional placements (QIPs), alongside 33 private transactions worth $1.8 billion—a significant rebound in investor activity.

“This quarter signifies a turning point in India’s real estate sector, showcasing robust performance in M&A, private equity, REITs, and IPOs. The increase in high-profile transactions, along with a growing appetite for income-yielding, institutional-grade assets, reflects enhanced institutional depth and confidence in the sector’s resilience and growth prospects,” stated Shabala Shinde, Partner and Real Estate Leader at Grant Thornton Bharat.

The institutional interest remains concentrated on income-generating commercial and retail assets, with rising activity in real estate technology and innovative platform structures.

“This shift is indicative of India’s property market transitioning into a more institutional and yield-focused ecosystem. Investors are increasingly leaning towards structured, income-generating opportunities characterized by robust governance, transparency, and regulatory clarity. Enhanced capital access and advancements in proptech drive efficiency and data-driven decision-making, further professionalizing and bolstering accountability in the sector, setting the stage for sustainable long-term growth,” remarked Chintan Sheth, CMD of Sheth Realty.

During the quarter, M&A activities reached 21 deals valued at $843 million, primarily driven by domestic transactions totaling $838 million. Major deals included The Phoenix Mills’ acquisition of Island Star Mall Developers, alongside strong interest in operational assets. Mindspace REIT’s complete acquisition of The Square marked its first third-party purchase since going public.

Private equity investments rebounded with 12 deals worth $859 million, representing a 71% increase in volume and a 48% increase in value compared to the previous quarter. Commercial assets and real estate technology were at the forefront of inflows, notably Prime Offices Fund’s $290 million investment in RMZ One Paramount.

On the public market side, five IPOs raised $805 million, and four QIPs totaled $344 million, with Knowledge Realty Trust’s $547 million IPO accounting for 68% of total fundraising.

Real estate operators and commercial developers represented 70% of deal volume and 91% of total value, while activity in residential development showed signs of slowing. The real estate technology and consultancy sectors experienced notable growth in deal count and value.