AHMEDABAD: Gujarat’s real estate sector is undergoing a significant transformation as redevelopment and joint development projects rapidly gain traction due to rising land prices and changing business models. Official statistics reveal a notable increase in registered development agreements, indicating that builders and landowners are opting for partnership models rather than outright land acquisitions.

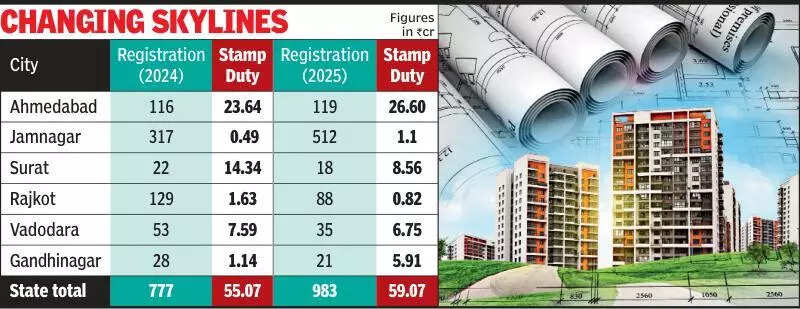

In 2024, a total of 777 redevelopment and joint development agreements were recorded in Gujarat, generating over Rs 55 crore in stamp duty for the state government. The momentum continued into 2025, with 983 agreements registered by November 30, yielding more than Rs 59 crore in stamp duty—a clear sign of intensified interest in such ventures.

Ahmedabad is at the forefront of this shift, having registered 116 development agreements in 2024, contributing Rs 23.64 crore to the state’s stamp duty. In 2025, 119 agreements have already been documented, with collections increasing to Rs 26.60 crore. Experts in real estate attribute much of this activity to the redevelopment of existing housing societies.

Industry insiders suggest that escalating land prices are pushing developers towards joint development arrangements, allowing them to share risks and benefits. For landowners, this model yields significantly better returns than traditional land sales.

“The increase in redevelopment projects in Ahmedabad reflects greater clarity today for developers and buyers alike,” stated Tejas Joshi, president of CREDAI Gujarat. He noted that specific incentives, such as reduced FSI for redevelopment projects, could further stimulate this trend, reshaping the city’s skyline.

Joshi added, “Landowners are keen to leverage their assets by collaborating with developers, which also fosters long-term business opportunities for future generations.”

Developers are echoing this sentiment. Taral Shah, a local developer, explained that joint development and joint venture models are becoming the preferred choice, particularly in high-value areas. “While landowners may receive payments later, they earn 20–25% more compared to a straightforward land sale. In premium regions, their share from project sales is considerably higher,” he elaborated.

From a legal perspective, redevelopment arrangements provide clarity. Advocate Ravi Shah highlighted that societies undergoing redevelopment typically enter into agreements that incur a stamp duty of 3.5% and a registration fee of 1%, based on the jantri value of land and construction.