BENGALURU | MUMBAI: US investment firm Blackstone is set to acquire up to a 55% stake in the Ritz-Carlton Bengaluru from Nitesh Land.

Sources indicate that Blackstone’s stake acquisition of 51-55% could cost approximately ₹600-700 crore, valuing the 277-room luxury hotel between ₹1,200 and ₹1,400 crore. The hotel, managed under the Ritz-Carlton brand by Marriott International, generated earnings before interest, taxes, depreciation, and amortisation of ₹105 crore for FY25.

“Blackstone will purchase the stake in Nitesh Residency Hotel, the owning entity. The agreement is signed and expected to finalize within this quarter,” shared an anonymous source.

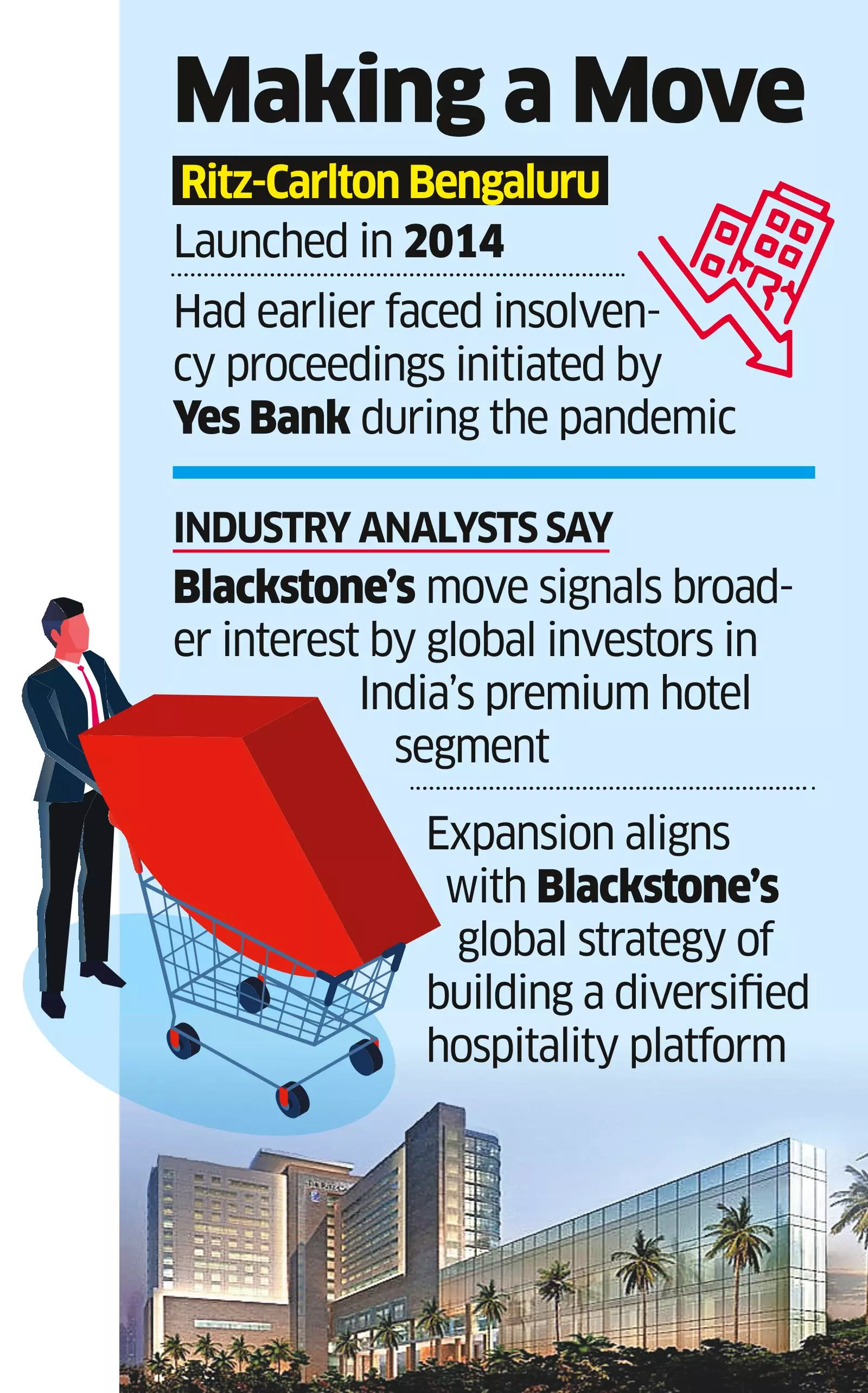

Post-transaction, Nitesh Shetty, founder of Nitesh Land, will maintain a 45-49% stake in the entity. The hotel previously faced insolvency proceedings initiated by Yes Bank during the Covid-19 pandemic, although these were later suspended by the Karnataka High Court and resolved through mediation.

“Nitesh Land has redeemed shares held by Apollo Global post-Covid. Kotak Mahindra Bank will replace Yes Bank as the hotel lender,” said another source.

Axis Securities served as the transaction advisor, with Cyril Amarchand Mangaldas, JSA, Trilegal, EY, PwC, and Kotak Securities involved in various capacities.

An inquiry sent to Nitesh Land went unanswered, while Blackstone opted not to comment.

Launched in 2014, the Ritz-Carlton Bengaluru was Nitesh Group’s flagship hospitality venture and stands as one of India’s few independently owned luxury five-star hotels, competing against establishments managed by renowned chains like Leela, Oberoi, ITC, and Taj.

Industry analysts believe Blackstone’s actions reflect a growing interest from global investors in India’s premium hotel sector, which has rebounded significantly due to corporate travel, domestic tourism, and a rise in meetings, incentives, conferences, and exhibitions.

Average room rates and occupancy levels in key Indian markets have exceeded pre-pandemic figures, prompting institutional investors to seek opportunities within the limited availability of upscale urban accommodations.

This expansion aligns with Blackstone’s global strategy of establishing a diverse hospitality portfolio. The firm had previously listed a hotel portfolio named Ventive Hospitality, valued around ₹18,000 crore. With the Ritz-Carlton acquisition and a potential JW Marriott deal, Blackstone would hold stakes in two landmark assets in Bengaluru, enhancing its position in India’s evolving hospitality investment landscape.

The broader hotel investment sector in India is gaining significant momentum.