The Bengaluru Development Authority (BDA) is set to generate up to ₹1,800 crore through the auction of prime urban land, enhancing efforts to monetize land assets and increase revenue.

This initiative is anticipated to draw competitive bids from top real estate developers, especially amid ongoing land shortages and high demand in metropolitan areas.

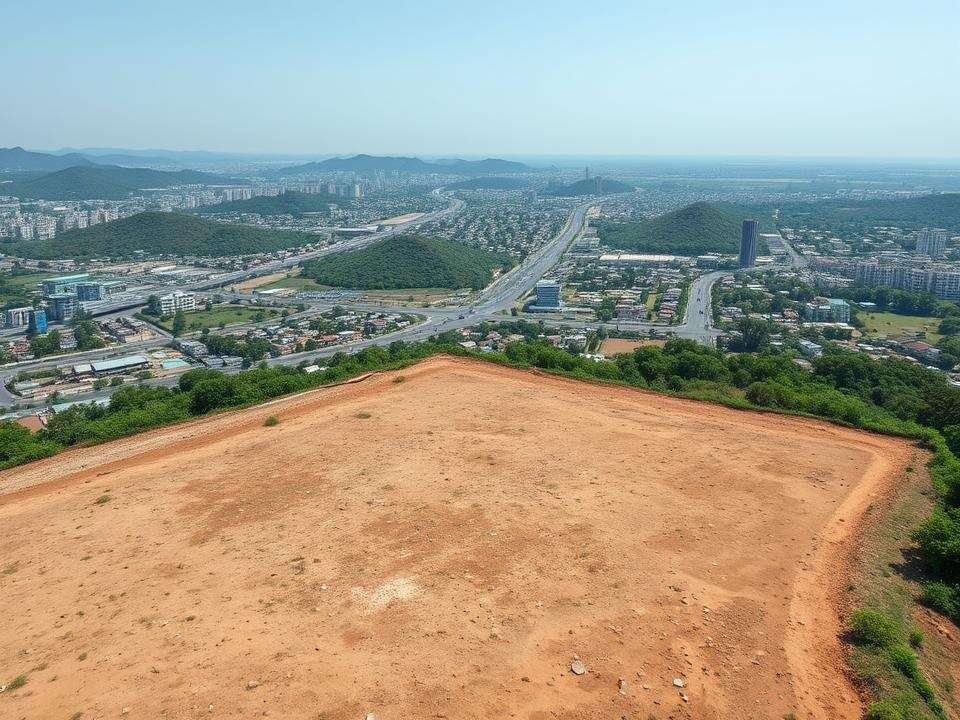

Part of the monetization strategy includes BDA’s planned e-auction for three substantial commercial land parcels in Konadasapura, located along the rapidly developing Whitefield–Hosakote Road corridor in east Bengaluru. The largest parcel covers over 52 acres (approximately 2.13 lakh sq. metres), with two smaller sites measuring 2.19 acres (10,037 sq. metres) and 1.31 acres (7,193 sq. metres) each. These parcels are being sold on an “as-is, where-is” basis.

The e-auction is set to commence on December 1, 2025, with the deadline for expressing interest on December 15. Live online bidding is scheduled for December 17-18, featuring a minimum bid increment of ₹500 per sq. metre and a requirement for at least two bidders per site, as noted in a notification from the authority.

Successful bidders must pay 25% of the bid value immediately, with the remaining 75% due within 45 days of receiving the allotment letter.

Gaurav Kumar, Managing Director of Capital Markets and Land at CBRE India, stated, “Government-owned lands offer potential buyers reassurance regarding secure title, zoning, and clear building guidelines. The BDA’s auction of prime land presents a valuable opportunity for developers to invest in parcels where construction can begin promptly and smoothly.”

Real estate experts indicate that the broader land disposal initiative focuses on strategically positioned plots held by several public agencies, including urban development authorities and other government-owned land earmarked for monetization. The tender structure will allow for freehold or long-term lease agreements, depending on land-use regulations and localities.

The Bangalore property market has been flourishing, with leading developers such as Prestige Group, Sobha Ltd, Godrej Properties, Puravankara, Brigade Enterprises, and Asetz Property acquiring large land parcels.

As private land inventories diminish amid a continuing property upswing, developers are increasingly looking to government auctions to boost their land banks, particularly in the Whitefield area.

Recent government-led auctions in various cities have demonstrated a strong appetite for premium land assets. For instance, the Telangana government achieved a ₹3,135-crore sale in the Raidurg financial district in Hyderabad, and Mumbai’s municipal corporation recently put a 6-acre Worli parcel up for auction with a base price of ₹1,348 crore.

In Bengaluru, BDA’s ongoing e-auctions throughout 2025—covering both residential and commercial sites—are aiding the city’s project pipeline, even as private developers actively pursue direct land acquisitions.

Bengaluru’s housing market has shown robust upward trends, particularly in premium segments and larger units. According to JLL India, approximately 45,815 residential units were sold in Bengaluru from January to September 2025.