Axis Bank has become the first creditor to seek buyers for its outstanding exposure to the financially troubled Lavasa Corp, while other lenders are still evaluating their options due to the ongoing litigation issues tied to the resolution process.

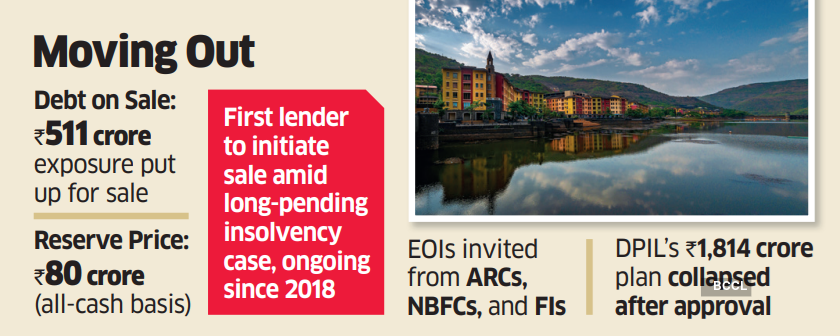

On Monday, Axis Bank listed its ₹511 crore claims for sale with a reserve price of ₹80 crore, available on an all-cash basis. As the fifth-largest creditor to the distressed private hill city, Axis is actively soliciting expressions of interest (EoIs) from asset reconstruction companies (ARCs), non-banking finance companies (NBFCs), and other financial institutions.

The deadline for submitting documents is November 18, with electronic auctions set for November 21.

“Axis has taken this step while others are still deliberating. They may be waiting to see how much interest Axis garners before making their own decisions. However, there is a pervasive lack of optimism among lenders regarding the prospects for recovery from this process,” said a source familiar with the situation.

Axis Bank did not respond to an email seeking comments.

Creditors, headed by the Union Bank of India, have faced difficulties with Lavasa’s bankruptcy proceedings since 2018. The company was initially admitted to bankruptcy due to environmental issues and a lack of key government clearances. Lavasa’s total debt to creditors stands at ₹6,642 crore.

This is the third attempt by lenders to find a buyer, following the abandonment of an earlier search due to the COVID-19 pandemic in 2020. In 2021, a plan for ₹1,814 crore proposed by Darwin Platform Infrastructure (DPIL) was approved by lenders and subsequently sanctioned by the NCLT in July 2023. However, this plan fell through when DPIL failed to meet the payment timeline.

The current process began in September 2024 but has faced intense competition from three bidders: Valor Estates, the Welspun-Ashdan Developers consortium, and Mumbai’s Yogayatan Group.

Valor Estates, Welspun-Ashdan, and an individual named Anuj Goyal have all filed various interlocutory applications (IAs) in the Mumbai National Company Law Tribunal (NCLT) seeking to amend their resolution plans, disqualify competitors, or adjust payment timelines.

“All these petitions are still pending hearings and may take weeks to resolve. In light of this, lenders are exploring alternatives to exit the case, which has been ongoing for more than seven years,” added the aforementioned source. The next hearing is scheduled for November 5.