KOLKATA: Property buyers in Kolkata and nearby regions will face increased stamp duty and registration fees due to the government’s revision of circle rates, which have risen by 15% to 90%. The new rates took effect on Wednesday.

The circle rate serves as the minimum price set by the government for property registration. According to sources from the finance department, the rate revision comes after a seven-year hiatus and is intended to address the disparity between circle and market rates in many areas. “For instance, some properties are sold for ₹9,000/sq ft while the circle rate is ₹6,000/sq ft. We’ve resolved this discrepancy through the revision,” an official stated.

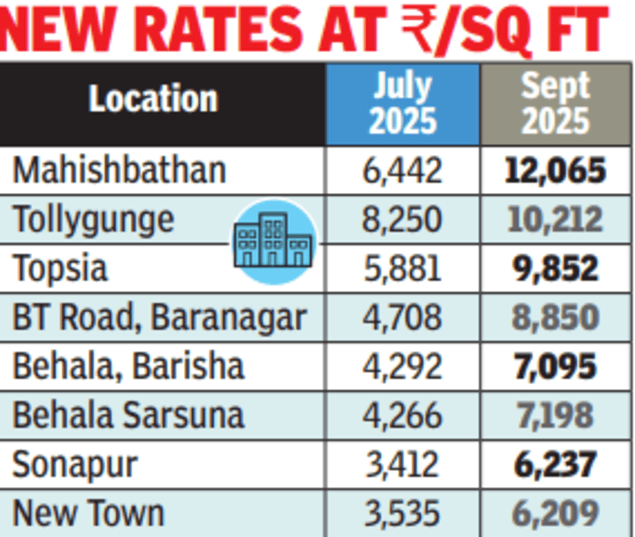

However, the significant increase in rates across various localities has drawn criticism from developers who argue that it may dampen demand. For example, the circle rate for Mahishbathan at the outskirts of Salt Lake has surged by 87% to ₹12,065/sq ft, surpassing the ₹10,212/sq ft rate in Tollygunge. In Baranagar on BT Road, where numerous high-rise developments are underway, the circle rate has nearly doubled from ₹4,708/sq ft to ₹8,850/sq ft.

For most buyers, the jump in stamp duty and registration costs is particularly burdensome. In Kolkata and other urban areas, stamp duty is set at 6% for properties valued below ₹1 crore and 7% for those above ₹1 crore. At the new circle rates, many three-bedroom and some two-bedroom units in Kolkata will exceed ₹1 crore.

Credai West Bengal president Sushil Mohta noted that in certain areas, the updated circle rates now exceed market prices. “There is no problem when the circle rate matches market price. But if it’s higher, it leads to income-tax implications,” he explained. In such cases, both sellers and buyers may face tax on the difference in rates. Credai Kolkata president Apurva Salarpuria mentioned that it would have been advantageous for the industry to be included in this process.

Merlin Group managing director Saket Mohta added, “A mismatch between circle and market rates complicates transactions and may ultimately decrease stamp duty and registration revenue.”

Biplab Kumar, president (brand, consulting, and sales) at NK Realtors, the largest realty consultant in Eastern India, stated that in areas where market rates are lower than circle rates, sellers may feel pressured to raise their asking prices to align with the new standards. “Given the increased costs from higher stamp duty and registration fees, there might be a temporary decline in sales as buyers adjust or postpone their purchases,” he remarked.

Vivek Rathi, national director (research) at realty consultant Knight Frank India, however, highlighted that Kolkata’s home registrations saw a 37% year-on-year increase between January and August 2025, despite the rollback of pandemic-era incentives on stamp duty and circle rates. “In this context, the circle rate hike is likely to have a minimal impact on sales volume, as buyers mainly consider market prices, affordability, and the sentiment surrounding home ownership as greater influencers,” he noted.