Mumbai, which stands as the nation’s largest and priciest property market, has achieved its highest-ever stamp duty earnings for January. This surge can be attributed to substantial transactions, despite a decline in registration volumes.

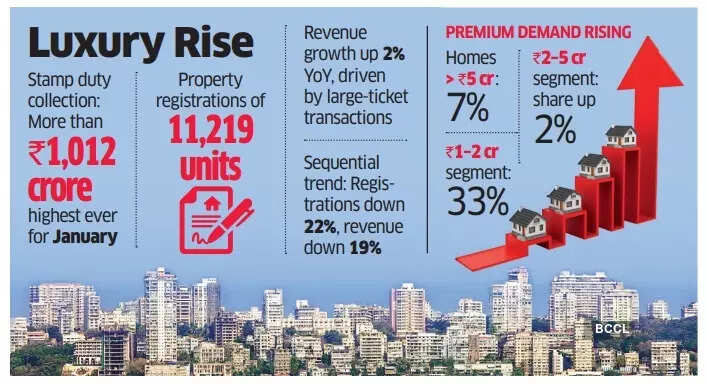

According to data from the Inspector General of Registration (IGR) and Controller of Stamps, Maharashtra, the financial hub recorded 11,219 property registrations in January, generating over Rs 1,012 crore in stamp duty revenue for the state.

Registration numbers saw an 8% decrease compared to the previous year, yet this performance marks the second-highest January on record. This trend suggests that transaction activity remains resilient in the face of year-on-year declines.

“Although there was a drop in registration volumes, this is partly due to the typical seasonal fluctuations seen in January, compounded by operational challenges towards the month’s end. However, the maintained revenue underscores ongoing consumer confidence, driven by stable economic conditions and significant infrastructure advancements. An increasing proportion of premium home purchases indicates a structurally sounder market,” stated Shishir Baijal, CMD of Knight Frank India.

Stamp duty collections have risen by 2% year-on-year, largely due to the growing proportion of large transactions. This ongoing demand reflects positive sentiment among homebuyers, solid economic conditions, and continued infrastructure investments throughout the city.

“Buyers are now favoring quality, connectivity, and infrastructural enhancements over mere price points. We are observing increased interest in mid-to-premium projects, particularly in metro-connected micro-markets and business hubs. End-users and upgrade buyers now represent a larger segment of the market, which supports stable demand and better realizations for developers,” remarked Parthh K Mehta, CMD of Paradigm Realty.

Residential properties continue to lead market activities, constituting almost 80% of total registrations.

On a sequential basis, property registrations fell by 22% in January with revenue dipping by 19%. This downturn is primarily linked to the usual seasonal slowdown observed during this month. Traditionally, both registrations and revenue collections witness a decline in January following the strong transaction activity of December.

The registration momentum in Mumbai is increasingly favoring higher price segments, with homes exceeding Rs 5 crore making up 7% of total registrations in January, a rise from 6% the previous year, indicating a burgeoning luxury market.

Conversely, the share of properties priced below Rs 1 crore has decreased due to affordability issues impacting buyer confidence in this segment. The portion of properties valued between Rs 2-5 crore increased by 2%, while the segment priced between Rs 1-2 crore rose to 33% from the previous year’s 30%.

Properties under 1,000 sq ft dominate registrations, accounting for 83% of the total, consistent with last year’s trends. The 500-1,000 sq ft category remains the most sought-after, balancing affordability with usable space for end-users.

Larger homes maintain a niche audience, with units sized 1,000-2,000 sq ft witnessing a slight dip of 1% to 24%, and the share of apartments exceeding 2,000 sq ft remaining steady at 3%.

Suburban areas continue to drive activity, with the western and central suburbs accounting for 87% of all registrations that month. The western suburbs led with 57%, while the central regions contributed 30%. In contrast, South Mumbai maintained an 8% share, and Central Mumbai’s share fell to 5%.