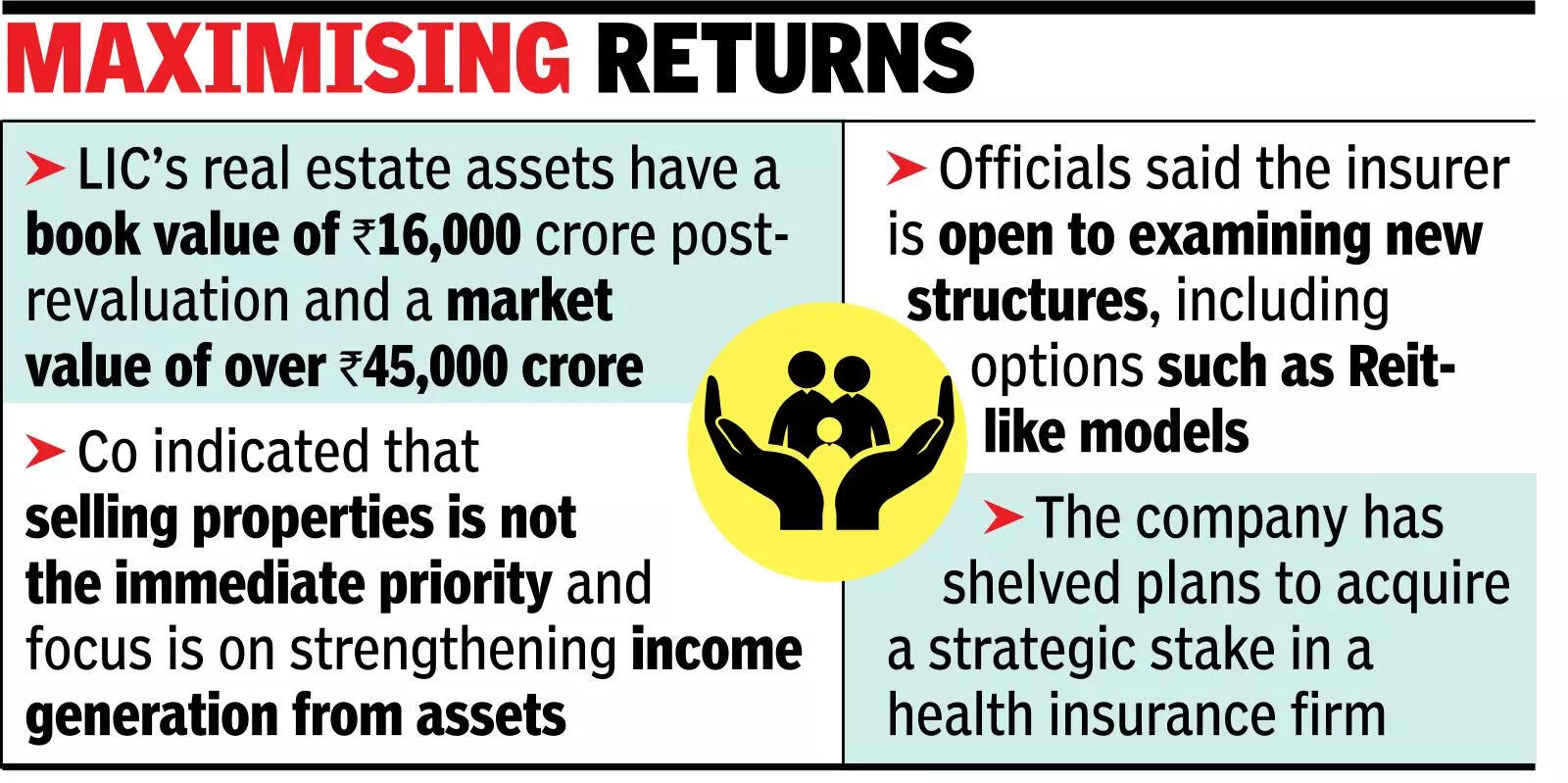

MUMBAI: Life Insurance Corporation (LIC) plans to enhance the yield on its real estate assets, valued at Rs 16,000 crore post-revaluation and over Rs 45,000 crore in market value. While officials noted that real estate generally provides a yield of 3-4%, capital gains remain significantly higher. Additionally, LIC has paused its plans to acquire a strategic stake in a health insurance company.

During a press conference following the board meeting, MD & CEO R Doraiswamy stated that LIC will take a cautious approach towards its previous intention to enter the health insurance market, a plan initiated by his predecessor. “We were considering investing in a standalone health insurance company to learn more about the market. However, after evaluation, we believe it’s not immediately necessary. We will proceed only if a suitable opportunity arises,” he said.

Officials disclosed that LIC is reassessing its entire real estate portfolio to discover methods to improve yields. Currently, selling properties is not a priority, as the focus remains on optimizing income generation from these assets. They are also open to exploring new structures, including options similar to REITs, though no decisions have been finalized.

In her Budget speech, Finance Minister Nirmala Sitharaman mentioned that the government intends to expedite the recycling of significant real estate assets from central public sector enterprises through the establishment of dedicated REITs.

For the quarter ending December 2025, LIC reported a standalone net profit of Rs 12,958 crore, reflecting a 17.2% increase from Rs 11,056 crore in the same period last year. Profit before tax also rose by 16.7% to Rs 12,897 crore compared to Rs 11,056 crore, as per the insurer’s reviewed financial results. Additionally, net premium income surged by 17.5% to Rs 1,25,613 crore, up from Rs 1,06,891 crore, driven by growth in new business and single premium products.

LIC has yet to decide on whether to sell its stake in the NSE, where it holds a significant share, in the upcoming IPO.