NOIDA: Twenty-two real estate projects in the city owe Noida Authority approximately ₹5,560 crore in dues, leaving around 9,750 owners uncertain about when their flats can be registered. The Noida Authority has issued notices, frozen registries, and initiated recovery actions, including recovery certificates in collaboration with the district administration.

According to the state’s rehabilitation policy, dues could have been reduced to ₹4,260 crore if developers had paid the mandatory 25% upfront. The defaulting builders include those who partially paid after accepting the settlement, those who accepted the policy but paid nothing, and those who have not accepted it at all.

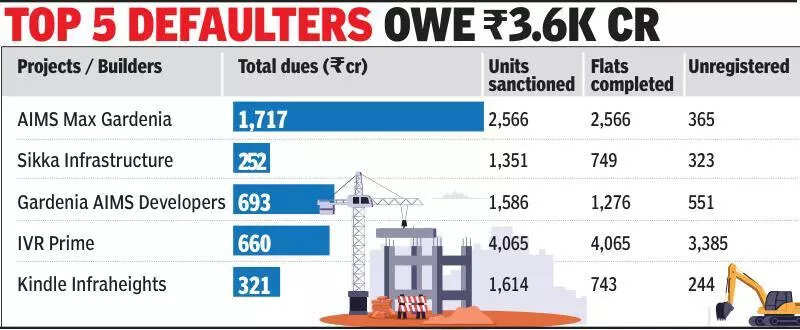

In the first category, 12 projects agreed to settle dues in installments but have made only partial payments. This group includes notable developers like AIMS Max Gardenia, Sunshine Infrawell, Mahagun Real Estates, Prateek Realtors, Antriksh Developers, Assotech Ltd, and others. The cumulative dues for this group total ₹3,379 crore, which could have been reduced to ₹2,432 crore had they accepted the rehabilitation policy. These projects encompass 15,508 flats, with 4,379 remaining unregistered.

AIMS Max Gardenia leads this group with dues exceeding ₹1,717 crore for its EcoCity project in Sector 75. Although over 1,600 flats have received occupancy certificates, about 365 are yet to be registered. Other notable dues include Mahagun Real Estates (₹97 crore), Prateek Realtors (₹197 crore), and various other developers with significant outstanding amounts.

So far, Noida Authority has recovered only ₹29 crore in partial payments from these 12 projects.

The second group consists of four projects that have accepted the state’s rehabilitation policy but have not made any payments. Their total dues amount to ₹1,239 crore, which would decrease to ₹1,006 crore under the policy. This group includes developers such as Kindle Infra Heights (₹320 crore), Gardenia AIMS (₹692 crore), Gardenia India (₹112 crore), and Futech Shelters (₹115 crore), covering 4,312 sanctioned flats, of which 795 remain unregistered.

“The Authority granted these developers recalculated dues, excluding the Covid-19 zero period. Yet, despite acceptance letters, they failed to pay the mandatory 25%. Registry permissions have been halted for these projects,” an official stated.

In the third category, six projects have not accepted the rehabilitation policy, with total dues at ₹945 crore, which would reduce to ₹821 crore under the state’s relief provisions. This group includes TGB Infrastructure (₹55 crore), MPG Realty (₹39 crore), AGC Realty (₹21 crore), and others, involving 9,216 sanctioned flats with 4,396 unregistered flats.

“We have provided ample time under the rehabilitation scheme. Developers who neither accept nor pay the required amount will face strict actions, including cancellation of allotments,” warned Noida CEO Lokesh M.

The state government’s December 2023 policy for stalled projects allows developers to settle old dues in installments with several relaxations, such as waiving penal interest and recalculating dues. Builders must pay 25% of the recalculated dues upfront to resume registries and obtain completion certificates.

Of the 57 defaulter projects in Noida, 35 opted for the scheme, while the remaining 22 developers delayed or defaulted on the first installment, prompting the Authority to issue show-cause notices.

Noida Authority has escalated action against non-compliant builders, issuing cancellation notices to the 22 defaulting developers between May and October 2024, with their dues prominently displayed at project sites. Some developers, including Prateek Realtors and Sikka Infrastructure, had unsold flats sealed as part of the enforcement.

For cases where builders initiated legal actions, including petitions under Section 41(3) or revision petitions, the Authority is providing reports to the government or High Court, while these matters are pending.

For developers like Mahagun Real Estates and Antriksh Developers, the Authority has requested the GB Ngara collector to recover significant arrears of land revenue—₹117 crore and ₹273 crore, respectively. Complaints were also lodged with Delhi’s Economic Offences Wing against several builders for investigations into non-compliance.

Court orders have issued ‘No Coercive Action’ in various cases until government or judicial reviews are completed. Builders such as Gardenia India, Gardenia AIMS, Futech Shelters, and MPG Realty have pending appeals related to depositing dues.

Several developers, including Kindle Infraheights and RG Residency, are currently in proceedings at the National Company Law Tribunal (NCLT). Court-approved resolution plans direct significant payments to the Authority. The ongoing default affects thousands of homebuyers who have paid fully but cannot register their flats due to outstanding dues. Homebuyers are urging a buyer-centric approach to allow registries on ready flats while the Authority recovers dues from the builders separately.

The Authority recently started installing notices outside housing projects with promoters who have not cleared dues or applied for the government’s rehabilitation scheme. Of the 57 projects eligible, 35 developers deposited ₹528 crore—approximately 25% of the recalculated dues, factoring in the zero period due to Covid-19.

“The government has provided extensive relief, including zero-period benefits and fair dues recalculation. Yet, many developers have shown no intention to comply. We will now enforce strict adherence to the rules,” stated Lokesh M.